Acetic Acid Weekly Report 07 Oct 2017

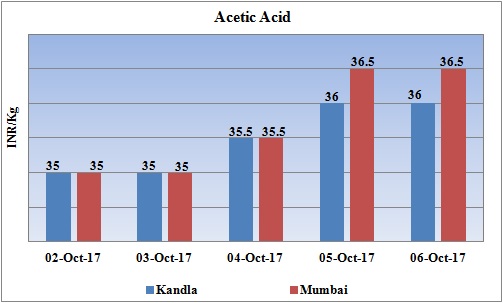

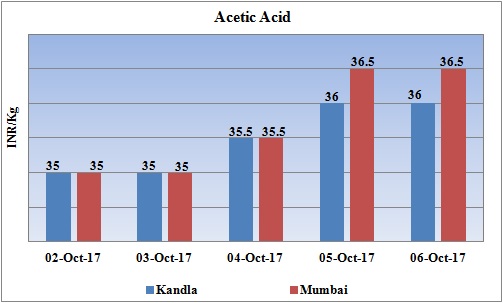

Weekly Price Trend: 02-10-2017 to 06-10-2017

- The above given graph focuses on the Acetic Acid price trend from 2nd Oct 2017 to 6th Octt 2017. If we take a quick look at the above given weekly prices, it can be observed that this prices tend to remain high for this week.

- By end of this week, prices were assessed at the level of Rs.35/Kg for Kandla and for Mumbai port for bulk quantity.

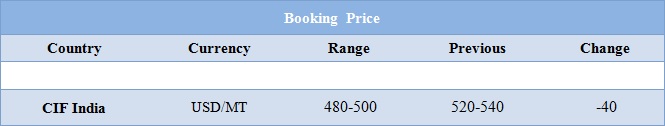

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed on firm note. There has been slight variation in domestic values. There has been limited supply of the chemicals in the market. Prices were assessed at the level of Rs.36/Kg for Kandla and Rs 36.5/Kg for Mumbai port for bulk quantity.

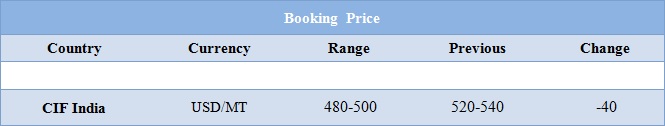

- CIF India prices of Acetic acid were assessed around USD 480-500/MTS, decreased by USD 40/MTS in compare to last week’s closing values. The overall market trend remained volatile throughout this week with majority of chemicals witnessing hike in international values.

- There has been slowdown in Acetic Acid values in international market on back of strengthening of Methanol price in international market. Even the Methanex has increased ACPC prices for Methanol by USD 50 for the October booking.

- Crude price remained volatile throughout this week. On Wednesday after slipping a bit oil prices rose again on Thursday based on expectations that Saudi Arabia and Russia would extend production cuts, although record U.S. exports and the return of supply from a Libyan oilfield dragged on the market.

- On Thursday, crude values closed on higher note. WTI on NYME closed at $50.79/bbl, prices have increased by $0.81/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $1.20/bbl in compared to last trading and was assessed around $57.00/bbl.

- As per market players, OPEC and other producers, including Russia, to cut oil output to boost prices could be extended to the end of 2018, instead of expiring in March 2018.

1$ : Rs. 65.38

Import Custom Ex. Rate USD/ INR: 65.95

Export Custom Ex. Rate USD/ INR: 64.30