Acetic Acid Weekly Report 07 April 2018

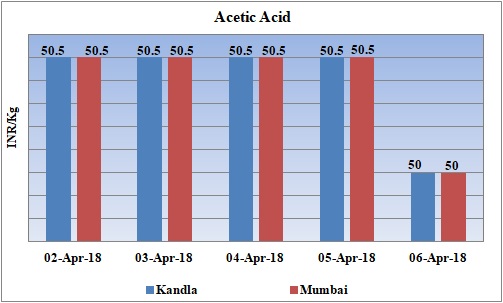

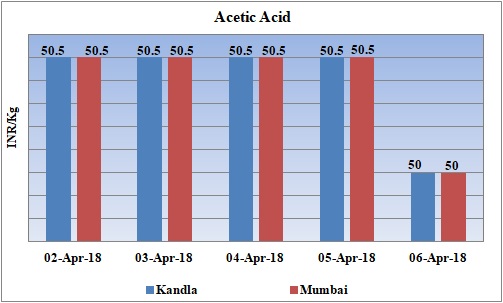

Weekly Price Trend: 02-04-2018 to 06-04-2018

- The above given graph focuses on the Acetic Acid price trend from 2nd April 2018 to 6th April 2018. If we take a quick look at the above given weekly prices, it can be observed that prices remained vulnerable throughout this week.

- By end of this week, prices were assessed at the level of Rs.50/Kg for Kandla and for Mumbai port for bulk quantity.

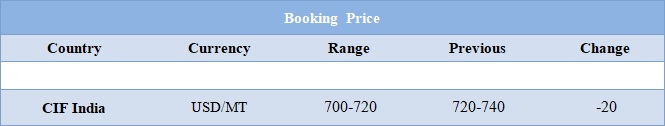

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.50/Kg for Kandla and for Mumbai port of India. There has been constant slowdown in Acetic Acid values in domestic as well international market.

- The prices have been weakened due to oversupply of the chemical in the domestic market and weak demand from downstream industry.

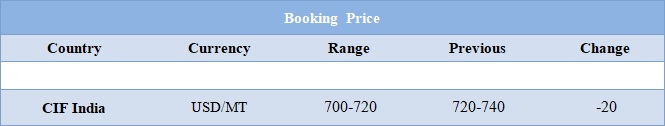

- CFR India values reduced for this week. Prices were assessed in the range of USD700-720/MT. Acetic Acid prices are likely to gain momentum in the second half quarter. The prices are expected to soar up due to limited supply and momentum in demand from downstream sector. In next month many domestic units of China will shut down their Acetic Acid unit for maintenance schedule. Demand from major downstream vinyl acetate (VAM), which accounts for about 20% of acetic acid consumption, is expected to increase, especially after a 450,000 tonne/year VAM unit wraps up maintenance in May.

- China based Shanghai Wujing Chemical Corp will shut down its Acetic Acid unit for maintenance turnaround. The unit will go off-stream either in April or May. The restart date has not been specified yet. Unit based in China has the manufacturing capacity of 700 MT/year.

- China based Yankuang Cathay Coal Chemical will shut down its Acetic Acid unit for maintenance turnaround. The unit will go off-stream in the first week of May. Unit is likely to remain off-stream for around one month. Unit based in China has the manufacturing capacity of 1000 MT/year.

- Lyondell Basell has restarted its Acetic unit last week. Earlier the unit was shutdown due to force majeure imposed on the production unit. Earlier the force majeure was imposed o 16 Feb due to failure of third party carbon monoxide supplier. The unit is based at La Porte and has the manufacturing capacity of 5,44,000 mt/year.

- This week crude oil prices have remained volatile. On Thursday oil prices increased from gains in U.S. equities markets as trade tensions between China and the United States eased, but the advance was limited by strength in the dollar.

- On Thursday, closing crude values have increased. WTI on NYME closed at $63.54/bbl; prices have decreased by $0.17/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.31/bbl in compared to last trading and was assessed around $68.33/bbl.

- As per report, U.S. crude production hit a new high, but that was not enough to change the overall bullishness. OPEC and its allies are collectively curbing 1.8 million barrels per day of crude output to help eliminate a global oil glut. The cuts run until the end of 2018 but Saudi Arabia has said they could be extended in some form into 2019.

1$ : Rs. 64.96

Import Custom Ex. Rate USD/ INR: 65.90

Export Custom Ex. Rate USD/ INR: 64.20