Weekly Toluene Report 6th November 2020

Weekly Price Trend: 02-11-2020 to 06-11-2020

- The above given graph focuses on the Toluene price trend for current week. Prices have remained highly volatile for this week.

- This week prices increase to the level of Rs.52/Kg and as week progressed the prices weakening started and there was decline in values.

- By end of the week prices were assessed at the level of Rs.50/Kg for Kandla and Mumbai ports.

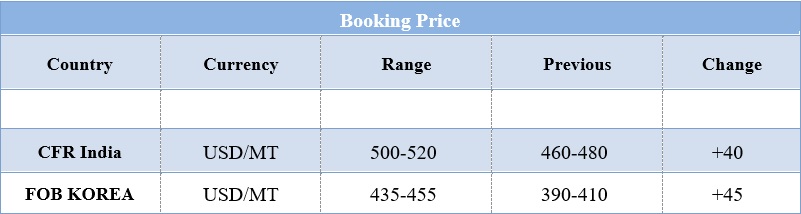

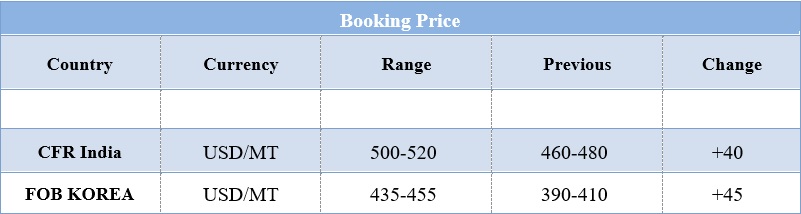

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market price was assessed at Rs.50/Kg for bulk quantity for Kandla and for Mumbai port. Domestic prices remained highly volatile for this week.

- CFR India prices were evaluated at USD 500-520/MT for this week. Prices increased by 40/MT in this week.

- FOB Korea values increased by USD 45/MT for this week which is last week’s rise in prices. Prices were assessed at the level of USD 445/MT.

- CFR China prices were assessed around USD 4065/MT for this week. On other side there was slight decline in CFR SEA prices and were assessed around USD 425/MT for this week.

- Domestic market has been operating at high note as prices increased but by end of the week the prices settle to its original levels. This hike was basically due to disruption in domestic supply. Domestic manufacturers have either shutdown their units or lowered their production in turn leading to rise in domestic values.

- Tight availability from the Middle East has also pulled up the import prices. The fire accident in Iran has disrupted the supply of chemical to Indian ports. Further there has been very limited shipments from Singapore and Thailand. According sources many cargoes have been canceled as a result import has dropped to 50 of its capacity.

- Looking at this scenario one of the major domestic manufacturer has also curtailed its production leading to more shortage of the chemical. These supply disruptions have affected south Asian market where demand was gaining amid this pandemic due to arrival of festivities.

- Crude market remained subdued for this week. With upcoming Diwali festival in next week the demand remains weak for this week.

- In oil field India has requested OPEC to review its pricing policies for the Asian market and end the premium it puts on its crude for Asia in virtual OPEC-India Dialogue meeting with OPEC Secretary General Mohammad Barkindo on Thursday.

- India depends on OPEC for 78 percent of its crude oil demand, 59 percent of liquefied petroleum gas (LPG) demand, and nearly 38 percent of its liquefied natural gas (LNG) demand, the Indian minister said, noting that India imported US$92.8 billion worth of oil, gas, and petroleum from OPEC members in the 2019-2020 financial year.

Cracker restart delayed by Lotte Chemical

South Korean petrochemical producer Lotte Chemical has delayed the restart of its 1.1mn t/yr Daesan cracker from the end of November to mid-December after an accident that resulted in worker injuries late last week.

Earlier the cracker was set to restart in November end but now its has been delayed further. The cracker was shut down in March due to explosion. The Daesan cracker has nameplate capacity to produce 1.1mn t/yr of ethylene, 550,000 t/yr of propylene and 190,000 t/yr of butadiene. It also feeds an aromatics unit that can produce 240,000 t/yr of benzene, 120,000 t/yr of toluene and 60,000 t/yr of solvent-grade mixed xylenes.

$ 1 = Rs. 74.20

Import Custom Ex. Rate USD/ INR: 75.15

Export Custom Ex. Rate USD/ INR: 73.45