Weekly Styrene Monomer Report 18th December 2020

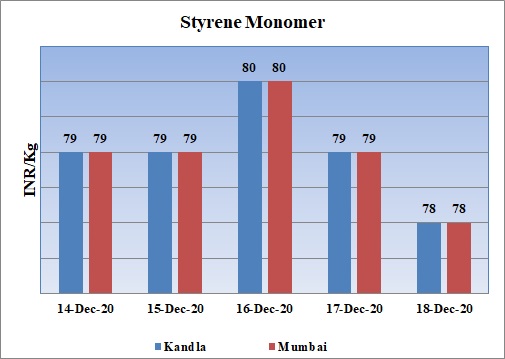

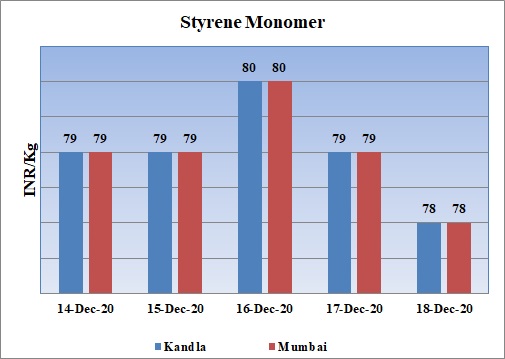

Weekly Price Trend: 14-12-2020 to 18-12-2020

- If we take a quick look at the above given weekly prices, it can be observed that domestic prices remained vulnerable for this week.

- Market opened with values of Rs.80/Kg and later as week progressed prices settled at the level of Rs.78/Kg in domestic market.

- Overall prices remained soft-to-stable for this week. Domestic values were assessed around Rs.78/Kg for bulk quantity at Kandla and Mumbai ports of India by end of the week.

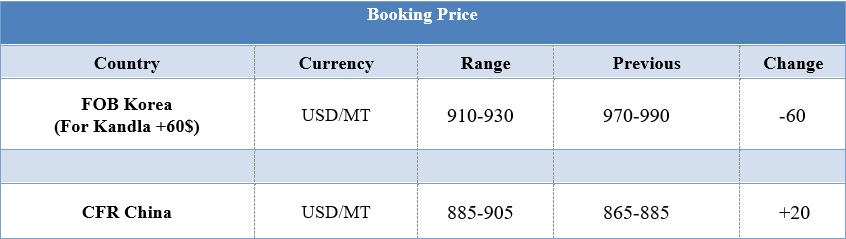

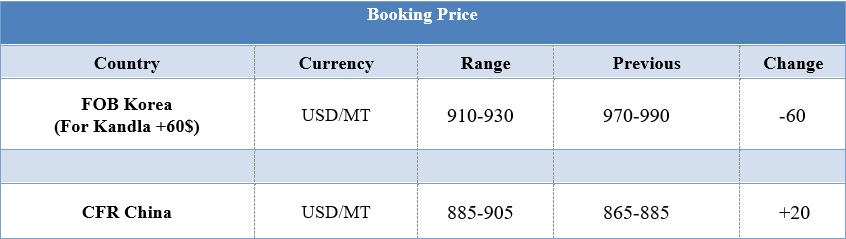

Booking Price

INDIA & INTERNATIONAL

- Domestic prices of Styrene Monomer were assessed at the level of Rs.78/Kg for this week.

- Domestic prices remained extremely vulnerable and after a significant rise in last few weeks, prices started to decline in domestic market.

- The spike in prices has now settled down in domestic market. FOB Korea values were assessed around USD 970-990, reduced by USD 60/MT for this week.

- On other side CFR China prices were assessed in the range of USD 885-905/MT increased by USD 20/MT for this week.

- Downstream Benzene prices has increased for this week. FOB Korea Benzene values were assessed around USD 648/MT for this week, increased by USD 23/MT for this week. CFR China prices were assessed around USD 634/MT for this week.

- Experts believe that shortage of SM which India often faces due to shortage in the supply will be sorted by end of January next year. The supply has been disrupted as many SM manufacturing units in South Korea has been either shutdown or has undergone unplanned maintenance.

- The other major point is that Indian government has ordered SM importers to undergo mandatory certification from May 2021. However, the deadline is likely to be extended by the Bureau of Indian Standards.

- On other side the expansion of China's styrene capacity in 2021 is expected to lengthen the market by approximately 6.88 million MT/year and exacerbate Asia's supply glut, while demand growth lags behind. It may potentially lead to output cuts. Among the new capacities coming on stream are Zhejiang Petrochemical's additional 1.2 million MT/year capacity, CNOOC Shell's 650,000 MT/year facility and Wanhua Petrochemical's 650,000 MT/year plant.

$1 = Rs. 73.55

Import Custom Ex. Rate USD/ INR: 74.45

Export Custom Ex. Rate USD/ INR: 72.75