Weekly Styrene Monomer Report 15th January 2021

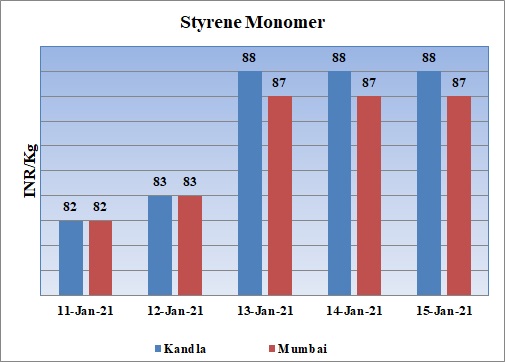

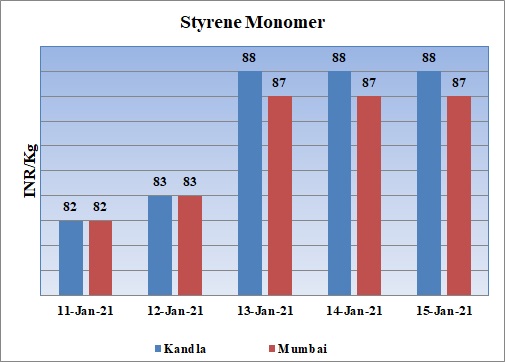

Weekly Price Trend: 11-01-2021 to 15-01-2021

- If we take a quick look at the above given weekly prices, it can be observed that domestic prices remained firm and strong for this week.

- Market opened with values of Rs.82/Kg and later as week progressed prices settled at the level of Rs.88/Kg in domestic market.

- Prices are likely to reach the level of Rs.95/Kg in this week. Overall prices remained firm and increased in this week.

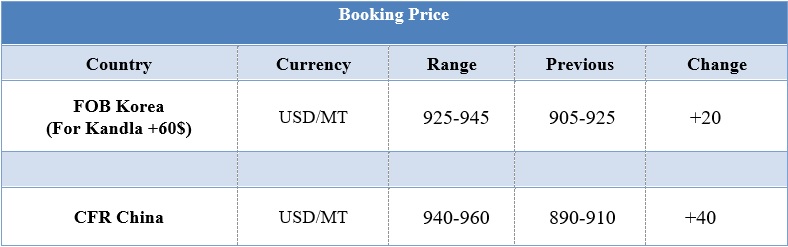

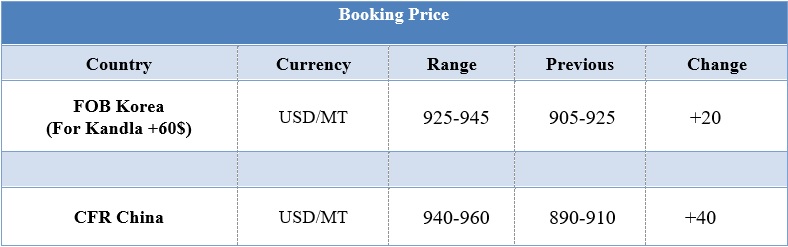

Booking Price

INDIA & INTERNATIONAL

- Domestic prices of Styrene Monomer were assessed at the level of Rs.88-90/Kg for this week.

- Domestic prices have increased heavily for this week. Prices increased by Rs.10/Kg in one-week span.

- FOB Korea prices were assessed around USD 925-945/MT for this week. Prices has increased by USD 20/MT in last one week.

- China prices were assessed around USD 940-960/MT, increased by USD 40/MT in last one week.

- Hike in the Asian market has been due to tightened supply owing an unplanned outage of many SM units.

- Domestic manufacturer SUPREME has increased its basic prices for SM. The new process are Rs.85/Kg increased by Rs.2.50/Kg for this week.

- On other side downstream Benzene prices has reduced for this week. FOB Korea Benzene values were assessed around USD 655/MT for this week, reduced by USD 17/MT last week. CFR China prices were assessed around USD 640/MT for this week.

- Unit like Changzhou New Solar Chemical has shut down its SM unit for maintenance turnaround. The units were shutdown owing to power failure in the company premises. Unit is based at Changzhou, Jiangsu province of China and has the production capacity of 6,50,000 mt/year.

- Abel Chemical has shut down its SM plant for maintenance turnaround. The unit was shut down in December end and is likely to remain off-stream for around 4-5 weeks. Unit is based at Taixing in Jiangsu province of China and has the production capacity of 2,50,000 mt/year.

- Strong moves have been observed in the key crude oil benchmarks-WTI, and Brent, in the last several months. This was initiated by the advent of positive news on the Covid front that the vaccines in development were extremely efficacious, promising an endpoint to the spread of the virus.

- Many countries have imposed fresh lockdown amid scare of new corona strain. In spite of these issues the demand trend is likely to remain positive. As implementation of vaccine has increased, experts believe that business activity will resume creating demand for petroleum products.

- Oil exploration and production companies like Oil and Natural Gas Corporation (ONGC) and Oil India (OIL) are not expecting this price recovery to be the last moment shot-in-the-arm to salvage the difficult 2020-2021.

$1 = Rs. 73.07

Import Custom Ex. Rate USD/ INR: 74.00

Export Custom Ex. Rate USD/ INR: 72.30