Weekly Report Toluene 5th February 2021

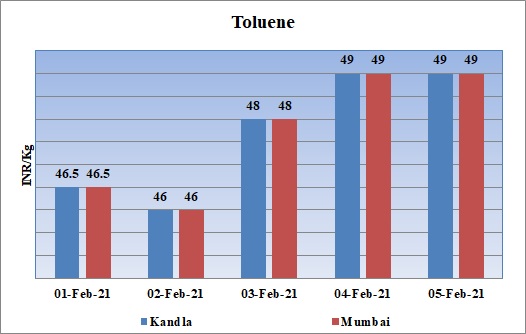

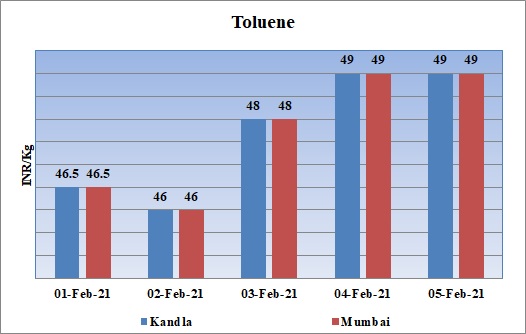

Weekly Price Trend: 01-02-2021 to 05-02-2021

- Domestic prices remained firm for this week. As the week proceeded further prices remained flat throughout the week.

- By end of the week prices were assessed the level of Rs.49/Kg for Kandla port and for Mumbai port.

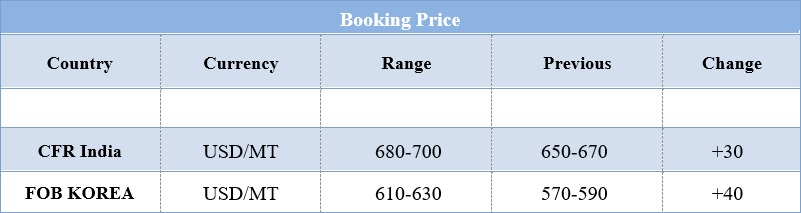

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market price was assessed at Rs.49/Kg for bulk quantity for Kandla and for Mumbai port. Domestic prices remained firm with no major changes in domestic prices.

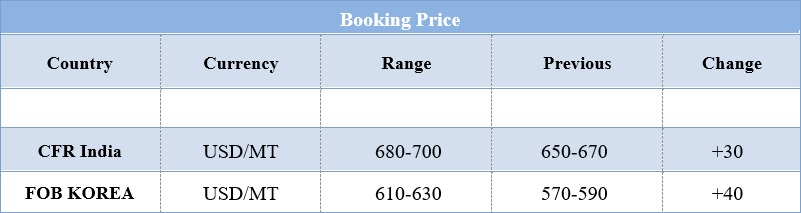

- CFR India prices were evaluated at USD 680-700/MT for this week. Prices increased by USD 30/MT for this week.

- FOB Korea values for Toluene was assessed around USD 620/MT for this week. Prices has improved by USD 40/MT in one week.

- This rise has been in particular due to soaring of crude price and its tightened supply in international market,

- CFR China prices were assessed around USD 585/MT on Friday closing. China market has closed now for Lunar vacation and will resume its operations after 10 days.

- CFR SEA prices were assessed around USD 560/MT for this week.

- FOB Korea values for Benzene were assessed in the range of USD 705/MT, with an increase of USD 45/MT for this week. CFR China values for Benzene were assessed around USD 710/MT.

- China market remained dull and most of the market activities remained subdued. The country will celebrate Lunar holidays for around ten days where most of the work will remain close.

- Continuous rising of prices has been quite hampering the economies of South Asian countries. Recently Indian Oil minister has slammed the decision of OPEC to cut down the production of oil. He said efforts at artificially distorting prices will have a dampening effect on the fragile global economic recovery that is underway.

- India relies on imports for more than 80 percent of its oil consumption. Like most other economies across the globe, Asia’s third-largest economy suffered a fallout from the pandemic, making it particularly vulnerable to oil price changes that benefit exporters. Its oil demand declined last year for the first time in two decades as a result of the pandemic. However, demand has been on the mend since the second half of last year, driven by higher fuel demand.

$ 1 = Rs. 72.92

Import Custom Ex. Rate USD/ INR: 73.80

Export Custom Ex. Rate USD/ INR: 72.10