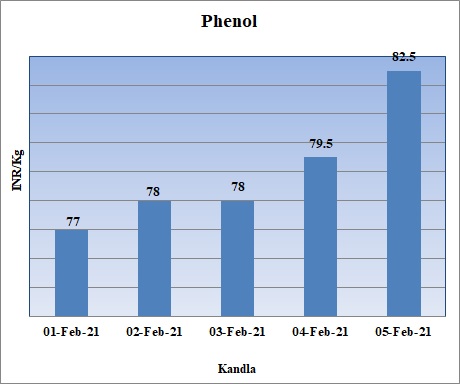

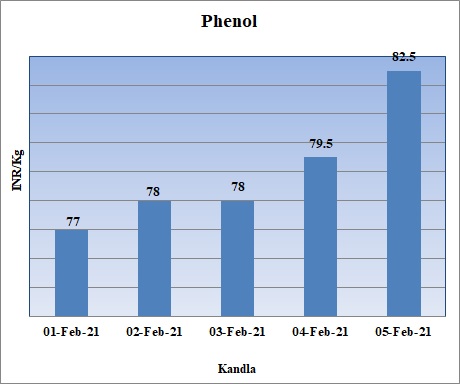

Weekly Phenol Report 5th February 2021

Weekly Price Trend: 01-02-2021 to 05-02-2021

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given week, prices have soared up in domestic market.

- Prices has improved by Rs.5.50/Kg for this week as week proceeded towards its closure and is likely to remain firm in the next week as well.

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.83/Kg for bulk quantity. Prices has improved as the week headed for its end.

- CFR India prices for this week were assessed in the range of USD 740-760/MTS for this week, increased by USD 25/MTS for this week.

- Tightened supply has been soaring up the Phenol prices in domestic market. On other side Benzene prices also remained firm for this week.

- FOB Korea values for Benzene were assessed in the range of USD 705/MT, with an increase of USD 45/MT for this week. CFR China values for Benzene were assessed around USD 710/MT.

- The other major reason has been due to soaring of crude price and its tightened supply in international market.

- China market remained dull and most of the market activities remained subdued. The country will celebrate Lunar holidays for around ten days where most of the work will remain close.

- Continuous rising of prices has been quite hampering the economies of South Asian countries. Recently Indian Oil minister has slammed the decision of OPEC to cut down the production of oil. He said efforts at artificially distorting prices will have a dampening effect on the fragile global economic recovery that is underway.

- India relies on imports for more than 80 percent of its oil consumption. Like most other economies across the globe, Asia’s third-largest economy suffered a fallout from the pandemic, making it particularly vulnerable to oil price changes that benefit exporters. Its oil demand declined last year for the first time in two decades as a result of the pandemic. However, demand has been on the mend since the second half of last year, driven by higher fuel demand.

1$: Rs. 72.92

Import Custom Ex. Rate USD/ INR: 73.80

Export Custom Ex. Rate USD/ INR: 72.10