Weekly Methanol Report 15th January 2021

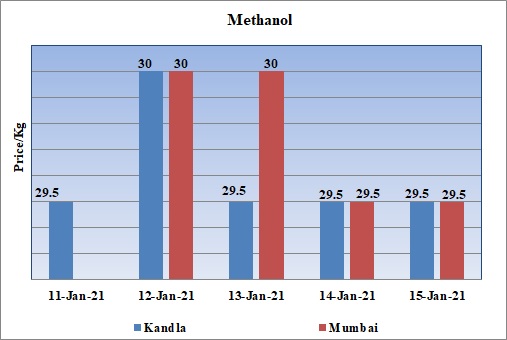

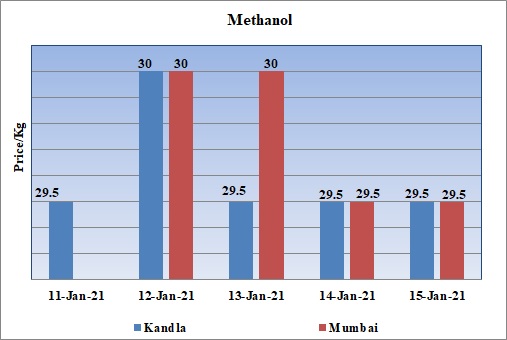

Weekly Price Trend: 11-01-2021 to 15-01-2021

- The above graph focuses on the Methanol price trend for the current week. Prices remained soft-to-stable for this week

- By the end of the week prices were assessed at the level of Rs.29.50/Kg for this week. Prices were anticipated to remained soft-to-stable for this week.

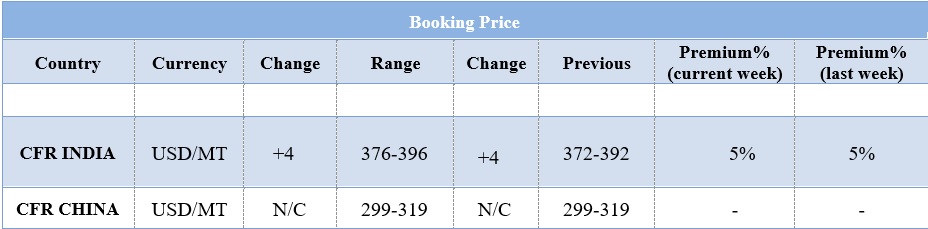

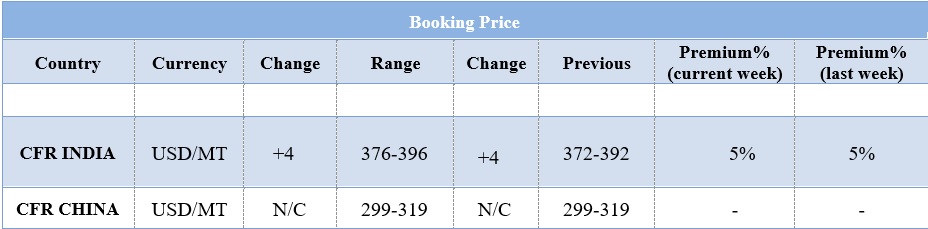

BOOKING SCENARIO

INDIA & INTERNATIONAL

- Domestic prices for Methanol were assessed at the level of Rs.29-29.50/Kg for this week.

- Prices for India in international market were assessed around USD 386/MT, with an increase of USD 4/MTS for this week. CFR China prices were assessed around USD 309/MT for this week. There has been no change in China prices.

- FOB Korea values were assessed around USD 373/MT for this week.

- On other side CFR SEA prices were assessed in the range of USD 380/MT.

- Domestic market for Methanol remained firm for this week. Due to festive holidays across the nation market remained dull in western India.

- Imports have been enough to cater the local demand. Prices are likely to linger in this range in domestic in India.

- Demand for chemical has remained stable and is likely to continue this trend in next few weeks as well.

- Malaysian Petronas Chemical Group has shut down its Methanol unit no 1 plant based Labuan in Malaysia.

- In the crude sector Strong moves have been observed in the key crude oil benchmarks-WTI, and Brent, in the last several months. This was initiated by the advent of positive news on the Covid front that the vaccines in development were extremely efficacious, promising an endpoint to the spread of the virus.

- Many countries have imposed fresh lockdown amid scare of new corona strain. Inspite of these issues the demand trend is likely to remain positive. As implementation of vaccine has increased, experts believe that business activity will resume creating demand for petroleum products.

- Oil exploration and production companies like Oil and Natural Gas Corporation (ONGC) and Oil India (OIL) are not expecting this price recovery to be the last moment shot-in-the-arm to salvage the difficult 2020-2021.

- There are also some sceptics of this oil price rally driven by Saudi Arabia’s production cuts. If US President-elect Joe Biden’s administration goes soft on Iran and lifts sanctions, the oil market will be oversupplied and prices may not recover. There is a lot of geopolitical turmoil that is going to steer the oil market in 2021.

$1 = Rs. 73.07

Import Custom Ex. Rate USD/ INR: 74.00

Export Custom Ex. Rate USD/ INR: 72.30