Weekly Acetic Acid Report 9 October Report 2020

Weekly Price Trend: 05-10-2020 to 09-10-2020

- The above given graph focuses on the Acetic Acid price trend from 5th Oct to 9th Oct 2020. If we take a quick look at the above given weekly prices, it can be observed that prices remained variable for this week.

- By end of the week prices were assessed at the level of Rs.32/Kg, for both the ports. Prices remained unchanged in last few days of the week.

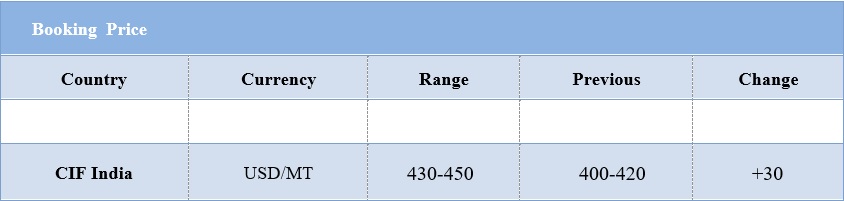

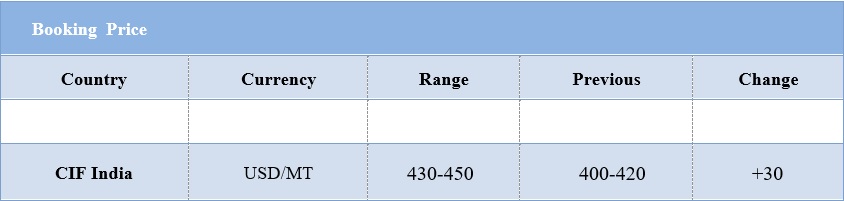

Booking Scenario

INDIA & INTERNATIONAL

- Domestic prices of Acetic acid were assessed in the range of Rs.32-33/Kg for Kandla and for Mumbai ports of India.

- CIF India prices for Acetic Acid were assessed around USD 430-450/MT for this week, there has been increase of USD 30/MT for this week.

- Domestic market has been operating at moderate rate this week. Although the global pandemic continues to affect the market consumers and manufacturers.

- There was mixed trend in Acetic Acid market as prices continued to fluctuate throughout this week. The rising prices pf Methanol in global Asian market has been affecting the pricing of Acetic Acid in global market.

- There has been improvement in demand of petrochemicals in India market past few weeks. The rise has been in particular due to beginning of festive season across the nation. Next week there will be starting of Navratri festival which will further boost the demand for chemicals like Acetic Acid, vinyl acetate monomer, acrylonitrile, and styrene. Most of the households make changes in their houses or make heavy purchase in this festive season.

- Although this rise has been quite lower in compare to last year figures. End products of petrochemical industry like paints, varnishes, automotive components, appliances, adhesives, and food packaging etc all have rise in sales with inception of this festive season.

- Acetic acid has gained support from the clinical demand and festive demand, although the year on year consumption is lagging behind.

- Methanol the main product of Indian market has now increased its reach and the amount f import has also increased. Last two months’ average import was of 85% of last year imports. Still heavy stock is available at Indian ports.

1$: Rs. 73.13

Import Custom Ex. Rate USD/ INR: 74.50

Export Custom Ex. Rate USD/ INR: 72.80