Weekly Acetic Acid Report 18th December 2020

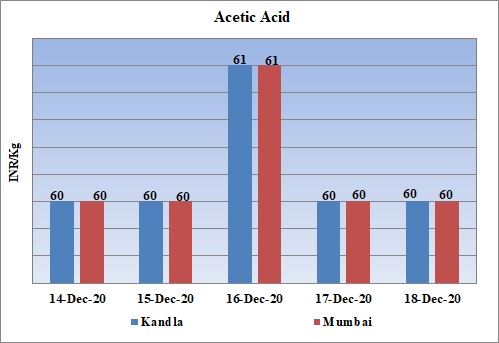

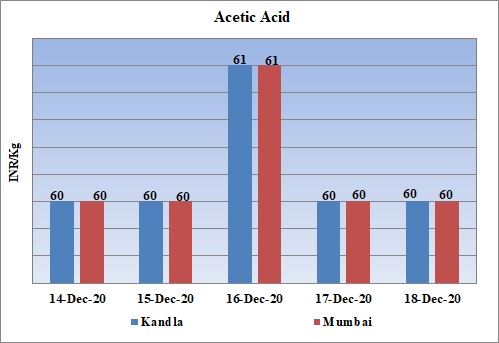

Weekly Price Trend: 14-12-2020 to 18-12-2020

- There has been no major change in domestic prices for Acetic Acid. The prices remained flat for most of the week.

- By end of this week prices were assessed at the level of Rs.60/Kg, for both the ports. There has been no major gain in prices for this week.

- Prices are likely to slow down in the next few days as local demand has now settled to its original level.

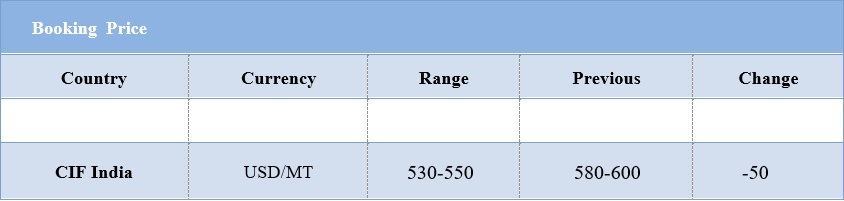

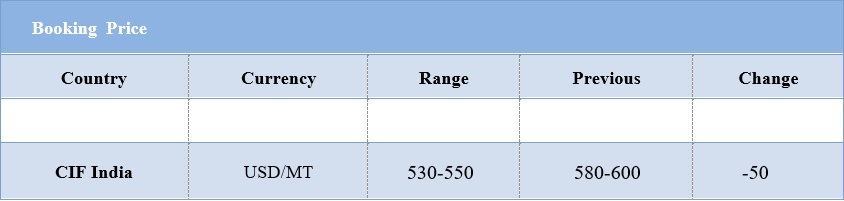

Booking Scenario

INDIA & INTERNATIONAL

- Domestic prices of Acetic acid were assessed at the level of Rs.60/Kg for this week.

- After an absolute heavy week of rise in demand prices remained flat for this week. Prices are likely to lower down in next few days.

- The local demand for Acetic Acid has also settled down and prices are heading towards their original level in domestic market.

- CIF India prices were assessed in the range of USD 530-550/MT for this week. Prices has reduced by USD 50/MT for this week.

- India has been importing huge chunk of Acetic acid from China. But due to pandemic there has been slowdown in imports from China. Moreover, the demand for Acetic Acid is highest in the period of Sept-Nov across Asian countries.

- Crude oil prices are on the rise again after a short reversal of fortunes prompted by a huge crude oil inventory build reported by the U.S. Demand from China and India has been on its toes. China has been the main driver of oil prices this year because of its massive refining capacity and growing storage capacity.

- Both countries are boosting their refining capacity in the meantime. China is already on track to surpass the United States as the world’s biggest oil refiner next year or the year after. Last year, it added some 1 million bpd to existing capacity, and there is another 1.4 million bpd of capacity under construction.

- India, too is in this running race of boosting it own capacity. In November, Prime Minister Narendra Modi surprised many when he said there were government plans to increase the country’s refining capacity twofold over the next five years. Earlier this year, Modi had said the plan was to double India’s refining capacity over ten years, but strong demand must have made the government reconsider the timeline. Currently, India has a refining capacity of 250 million tons, or a little more than 5 million bpd, based on a conversion factor of 7.33 barrels per metric ton of oil.

1$: Rs. 73.55

Import Custom Ex. Rate USD/ INR: 74.45

Export Custom Ex. Rate USD/ INR: 72.75