Vinyl Acetate Monomer Weekly Report 24 March 2018

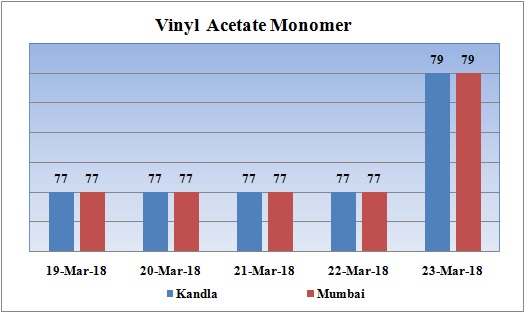

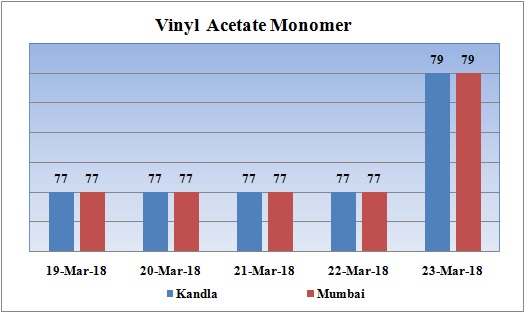

Weekly Price Trend: 19-03-2018 to 23-03-2018

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- There has been rise in domestic values for VAM. The local demand has persisted the prices to go on high range.

- By end of the week prices were assessed around Rs.77/Kg for Kandla port and Mumbai port.

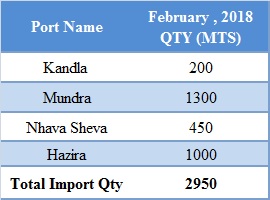

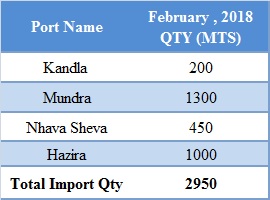

Total import of VAM at various ports of India in February 2018

The above chart depicts the import of VAM in the month of February 2018

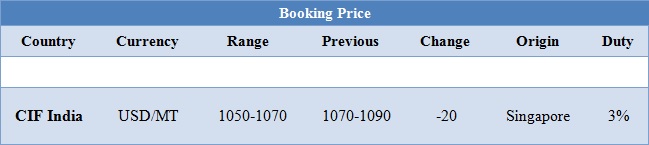

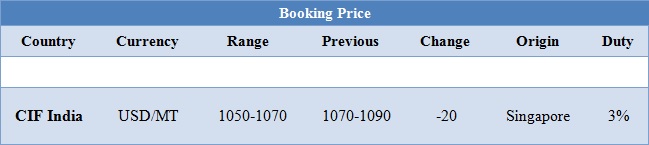

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM remained stable for this week in compare to last Friday’s assessed level.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.79/Kg at Kandla and Mumbai port for bulk quantity. There has been hike in domestic market.

- On other side prices reduced in international market. Prices were assessed in the range of USD 1050-1070/MTS, reduced by USD 20/MTS in compare to last week’s closing values.

- Acetic acid prices also remained firm in international market. This week oil prices have followed volatile inclination. Oil prices edged higher in choppy trade on Thursday, supported by a pickup in equity markets but pressured by expectations that crude supply will exceed demand later this year.

- An important decision has been taken by the Reserve Bank of India (RBI) to ban the lending credit will have an adverse impact on chemical importers in the country. The recent scam in PNB and many other defaulters has hit hard to the Indian banking system. The central banking authority has now decided to put a weight on LC and LOU. The implementation of this law will come in April month. This will in turn affect the GDP growth of the country. An LOU is generally used to fund imports and to avail short-term credit. It is also an undertaking by the issuing bank to pay in case of default by the one on whose behalf it was issued. The Indian importers believe that this ban will have an adverse impact on traders as import cost will shoot up. The most prominent chemicals are Phenol and acetone and other solvents are likely to witness a severe hike in values.

- This week crude oil prices have followed little volatility while increased through the week. On Thursday oil prices fell as investors booked profits after this week's rally, but losses were limited by the continuing efforts of OPEC and its allies to curb supplies.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $64.30/bbl; prices have decreased by $0.87/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.56/bbl in compared to last trading and was assessed around $68.91/bbl. Recently, market players continue to see fragility in the oil market.

- Profit-taking risks still appear large, strong output growth challenges the market-tightening narrative and the supply deals overdue transitioning remains blanketed in uncertainty.

$1 = Rs. 65.00

Import Custom Ex. Rate USD/ INR: 65.80

Export Custom Ex. Rate USD/ INR: 64.15