Vinyl Acetate Monomer Weekly Report 21 July 2018

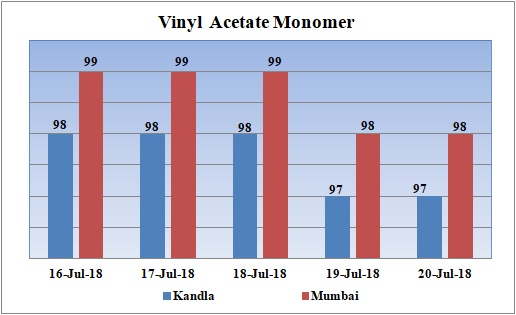

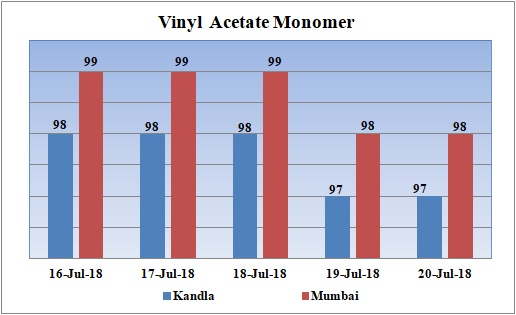

Weekly Price Trend: 16-07-2018 to 20-07-2018

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- Prices have reduced slightly in domestic market on back of improved supply coupled with slight stable in the prices of Acetic Acid.

- By end of the week prices were assessed around Rs.98/Kg for Mumbai port and Rs.97/Kg for Kandla port.

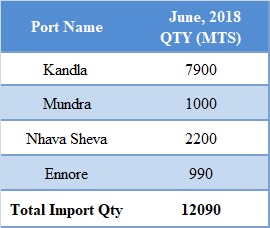

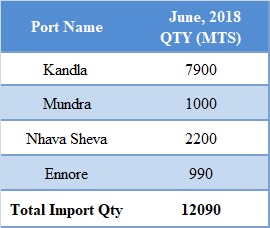

Total VAM imports at various ports of India in June 2018

The above table depicts the total imports of VAM at various ports of India in the month of June 2018.

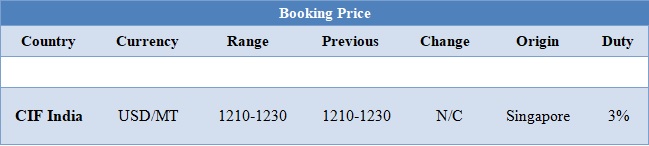

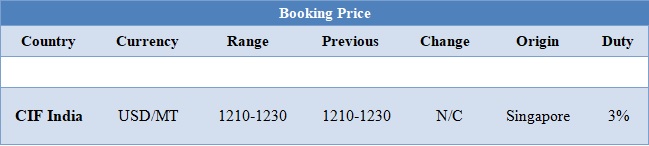

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM increased heavily again for this week. VAM with zero duty was available at USD 1220/MT in for traders.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.97/Kg at Kandla and Rs. 98/Kg for Mumbai port bulk quantity.

- There has been significant slowdown in Acetic Acid values in international market. This in turn has led to decline in the prices for VAM. CFR India values were assessed around USD 1220/MT for this week.

- Prices in Indian market are likely to remain weak as there are heavy rains in Mumbai and western part of India. There is a huge impact of monsoon season on the demand for majority of petchem products.

- This week oil prices have followed mixed trend. On Thursday, Brent crude fell as concerns about mounting supply returned after a brief rally on comments that Saudi Arabia's exports would fall in August. Crude also strengthened on forecasts that inventories at the U.S. oil delivery hub for WTI in Cushing, Oklahoma fell 1.8 million barrels, or 6.2 percent.

- On Thursday, closing crude values have remained mixed. WTI on NYME closed at $69.46/bbl; prices have increased by $0.70/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.32/bbl in compare to last closing price and was assessed around $72.58/bbl.

- As per report, Saudi Arabia expects its crude exports to drop by roughly 100,000 bpd in August as the kingdom limits excess production.

- As per report, Saudi Arabia's crude oil exports in July would be roughly equal to June levels. Despite international oil markets being well balanced in the third quarter, there would still be substantial stock draws due to robust demand.

$1 = Rs. 68.87

Import Custom Ex. Rate USD/ INR: 69.60

Export Custom Ex. Rate USD/ INR: 67.90