Vinyl Acetate Monomer Weekly Report 20 Jan 2018

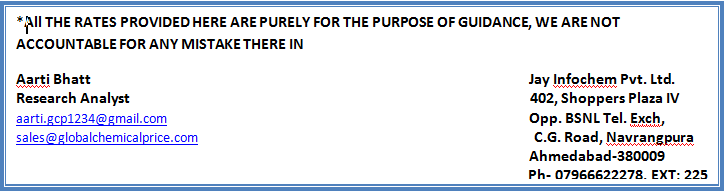

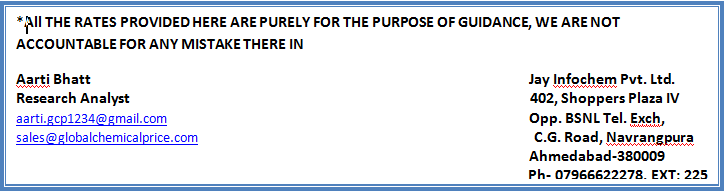

Weekly Price Trend: 15-01-2018 to 19-01-2018

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- There has been hike in domestic values for VAM. By end of the week prices were assessed around Rs.77/Kg for Kandla port and for Mumbai port.

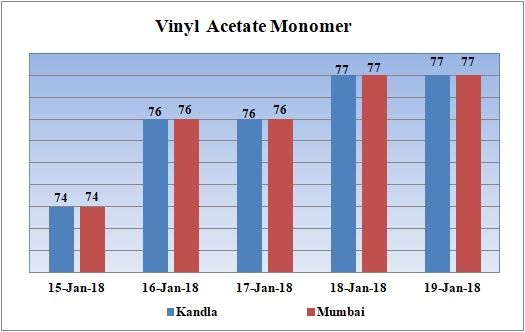

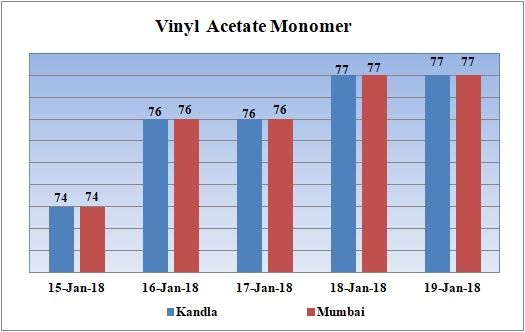

Total import at various ports in the month of December 2017

The above chart depicts the import of VAM at various ports of India in the month of December 2017.

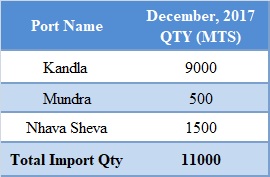

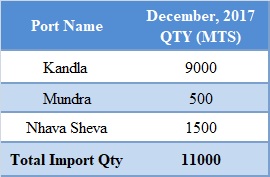

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM remained stable for this week in compare to last Friday’s assessed level.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.77/Kg at Kandla and for Mumbai port for bulk quantity.

- Last week there was an unprecedented hike in international prices for VAM. This week prices remained firm with slight slowdown in international market. Prices were assessed in the range of USD 1090-1110/MTS, slightly reduced by USD 20/MTS in compare to last week’s closing values.

- On other side there has been significant hike in values in Acetic Acid market. Prices were assessed in the range of USD 710-730/MTS, increased by USD 50/MTS in this week.

- This hike has been basically due to limited supply of chemical from China. VAM prices have increased heavily in China market. Prices for VAM increased by more than 500 yuan in one week. The limited supply due to transportation issues as major snowfall is being experienced in central and eastern China provinces.

- Major producers based in northern part of China have cut down their production due to lack of supply of feedstock Acetic Acid. Sinopec Chongqing SVW Chemicals has shut down their VAM unit in last week of December. This unit is one of the major suppliers of VAM in the country. The unit is expected to go on stream by January end. Unit has the production capacity of 5,00,000 tonnes/year.

- Acetic Acid prices have also increased heavily in China. It has increased by more than 25% in last two months. Heavy snowfall along with disrupted transportation facilities has put an halt on the supply of petrochemical industry.

- Demand is likely to gain more momentum after Lunar vacation in China as supply will be more weak and dull. After the Lunar vacation the other major producer Sinopec Great Wall Energy and Chemical’s unit is likely to shut down its VAM unit for maintenance.

- The leading manufacturer of VAM, Celanese has lifted its force majeure after long gap of four months. Earlier the unit was shut down in the month of August due to hurricane Harvey. VAM production has been restoring to normal level and is in position to meet up the commitments of its customer. Although it continue to face logistical challenges because of that storm, particularly dredging issues near the company’s 300,000 tonne/year plant in Bay City, Texas.

- Oil prices have followed volatile trend this week. On Thursday Oil rebounded after slipping below $69 a barrel, supported by a record drawdown of U.S. crude stockpiles at the Cushing, Oklahoma delivery hub, despite concerns that OPEC-led output cuts will increase supply from the United States.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $63.95/bbl; prices have decreased by $0.02/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.07/bbl in compared to last trading and was assessed around $69.31/bbl.

- As per report, the upside is now limited for oil prices. U.S. oil producers will ramp up production in the coming months. Some traders said that prices were unlikely to fall far due to the OPEC-led curbs and the risk of further disruptions.

$1 = Rs. 63.85

Import Custom Ex. Rate USD/ INR: 64.80

Export Custom Ex. Rate USD/ INR: 63.10