Vinyl Acetate Monomer Weekly Report 13 Oct 2018

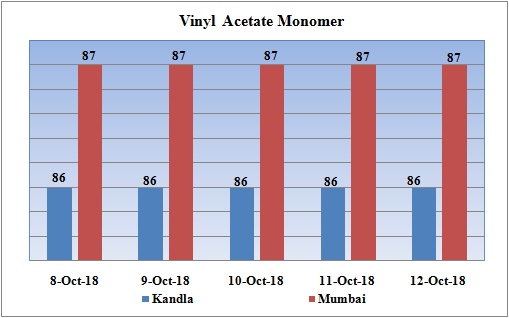

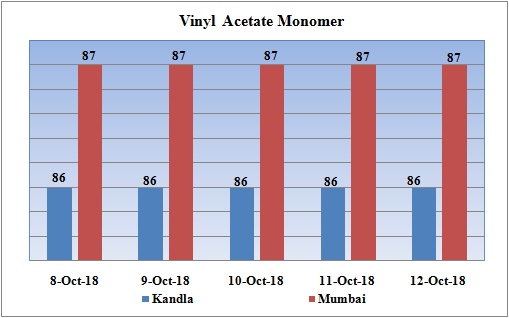

Weekly Price Trend: 08-10-2018 to 12-10-2018

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- This week there has been firmness in domestic values. Impact of fluctuation in crude values has also manipulated the domestic prices for VAM.

- By end of the week prices were assessed around Rs.87/Kg for Mumbai port Rs. 86/Kg for Kandla port.

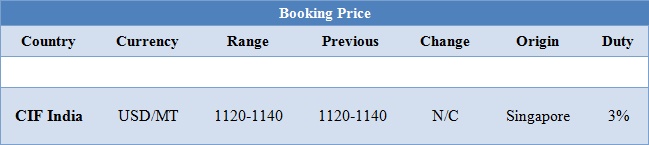

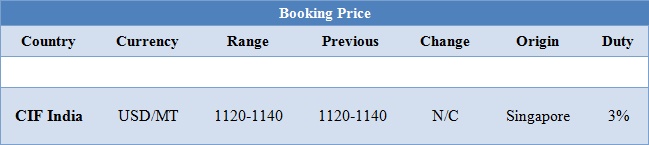

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM have increased significantly for this week.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.86/Kg at Kandla and Rs.87/Kg for Mumbai port bulk quantity.

- With rise in the prices for Acetic Acid in international market, prices for VAM have also increased heavily.

- CIF India prices remained unchanged for this week and were assessed in the range of USD 1120-1140 for this week.

- VAM is one of the key ingredients for adhesive companies such as Pidlite Industries. With rise in cost of crude derivatives the margins for the key industries using these as raw material are under immense pressure.

- Last week there was strong rally for crude prices and was expected to cross the mark of USD 100/bbl very soon. But this week scenario was totally different. Brent crossed the mark of $86 on Tuesday , lowered in last two days on back of investors sell off in the trading.

- The main story driving the oil market remains the loss of Iranian crude exports ahead of the full renewal of U.S. sanctions on Nov. 4. That deadline is still frightening large over the market and could help push oil prices back up.

- All the major nations unanimously agree that with Iran sanctions, a large chunk of oil will be removed from the market. How strong its impact is beyond everybody’s imaginations.

- Emerging markets like India are really struggling with higher oil prices coupled with continuous currency depreciation.

- Indian Rupee has depreciated more than by 15% year-to-date. Higher crude oil prices, demand from defense and oil marketing firms have contributed to the latest bout of weakness. Rupee was overvalued on trade weighted real effective exchange rate.

- China market is also facing the heat of rise in crude prices and deprecation of its own currency. Further the trade tariffs with US will affect the Chinese economy in long run. To check its impact China’s Central Bank has cut down the reserve requirement ratios (RRRs) by one per cent from October 15 which will inject a net USD 109.2 billion in cash into the banking system.

$1 = Rs. 73.54

Import Custom Ex. Rate USD/ INR: 74.60

Export Custom Ex. Rate USD/ INR: 72.90