Vinyl Acetate Monomer Weekly Report 04 August 2018

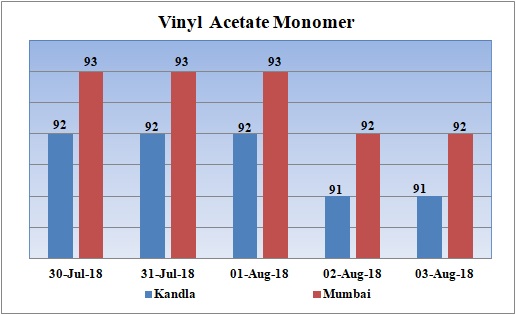

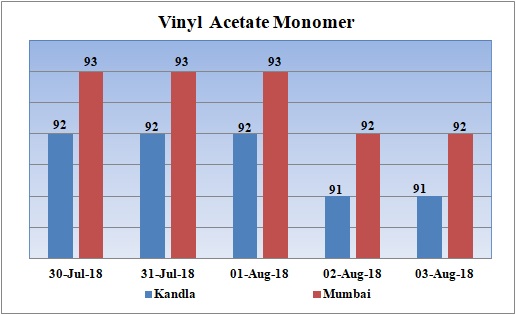

Weekly Price Trend: 30-07-2018 to 03-08-2018

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- Prices have reduced slightly in domestic market on back of improved supply coupled with slight stable in the prices of Acetic Acid.

- By end of the week prices were assessed around Rs.92/Kg for Mumbai port and Rs.91/Kg for Kandla port.

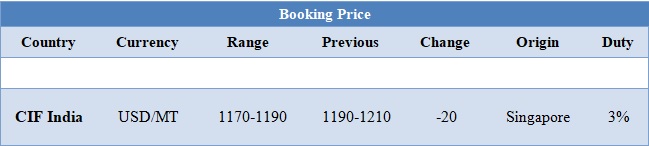

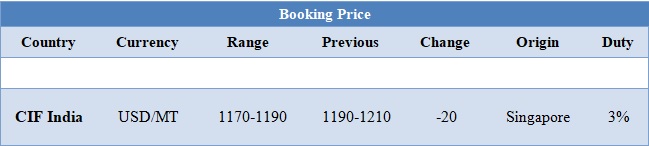

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM increased heavily again for this week. VAM with zero duty was available at USD 1180/MT in for traders.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.91/Kg at Kandla and Rs.92/Kg for Mumbai port bulk quantity.

- There has been significant slowdown in Acetic Acid values in international market. This in turn has led to decline in the prices for VAM. CFR India values were assessed around USD 1220/MT for this week.

- This week oil prices have followed mixed trend. On Thursday oil prices traded slightly higher, reversing course after a report that crude stockpiles at the U.S. storage hub at Cushing, Oklahoma fell in the latest week.U.S. stockpiles have been in the spotlight because they rose unexpectedly last week, stoking fears that the market is becoming oversupplied.

- On Thursday, closing crude values have increased. WTI on NYME closed at $68.96/bbl. Prices have increased by $1.30/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $1.06/bbl in compare to last closing price and was assessed around $73.45/bbl.

- As per market report, oil prices are feeling the effects of tensions over global trade, which could cause economic growth to slow.

- Trump has turned up pressure on China for trade concessions by proposing a higher 25 percent tariff on $200 billion of Chinese imports and China has said it will retaliate.

- "It is almost certain that China will impose additional duties on oil and refined products imported from the U.S. if the Trump administration implements additional tariffs on the next tranche of Chinese goods. This could severely dent the competitiveness of U.S. oil and derivatives in the Chinese market.

$1 = Rs. 68.60

Import Custom Ex. Rate USD/ INR: 69.25

Export Custom Ex. Rate USD/ INR: 67.55