Toluene Weekly Report 30 Sep 2017

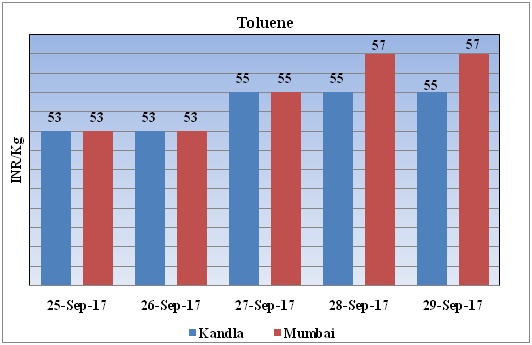

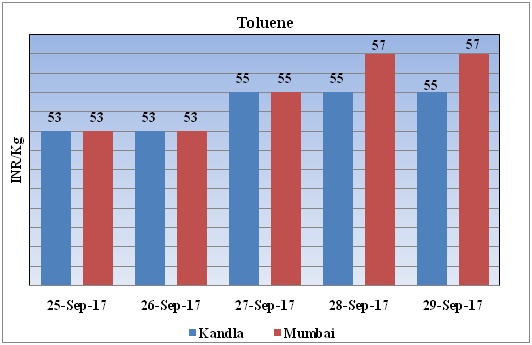

Weekly Price Trend: 25-09-2017 to 29-09-2017

- The above given graph focuses on the Toluene price trend for current week.

- This week prices have followed volatile trend. By the end of the week domestic prices were assessed at Rs 55/Kg for bulk quantity for Kandla and Rs 57/kg for Mumbai ports of India.

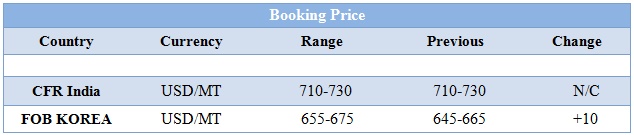

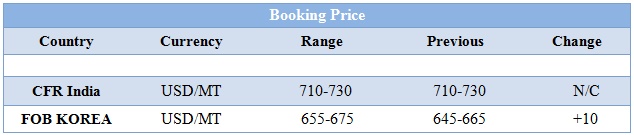

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs 55/kg for Kandla and Rs. 57/kg for Mumbai ports of India.

- CFR India prices were evaluated at USD 720/mt, prices have remained firm in compares to previous week.

- CFR China price of toluene were assessed at the level of USD 685/mt.

- FOB Korea prices were evaluated at USD 665/mt prices has increasedin compare to previous week.

- This week domestic toluene prices have remained soft-to-firm as no major deals and discussion has been heard.

- As per report, Toluene prices in south China plunge this week as supply returns to normal.

- As per market players, CNOOC REF and PC Huizhou plans to shut its aromatic plant.

- Sinochem Quanzhou also plans to shut its aromatic unit.

- For near term toluene demand will remain firm in China on national day holiday from 1st to 7th October.

- This week oil prices have followed mixed trend. Investors have really gained confidence in oil, after the OPEC cuts that were originally discussed earlier in the year are starting to take shape here, and oil production is being curbed.

- On Thursday, closing crude values have plunged.WTI on NYME closed at $51.56/bbl, prices have decreased by $0.58/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.49/bbl in compared to last trading and was assessed around $57.41/bbl. Due to the combination of production cuts and growing demand, oil could head up to its 2017 high, just above $55, or even $60 per barrel by year-end. A global supply glut has plagued the market for several years, and OPEC member countries and non-member producers have vowed to implement cuts to curb such oversupply.

$1 = Rs. 65.28

Import Custom Ex. Rate USD/ INR: 65.40

Export Custom Ex. Rate USD/ INR: 63.70