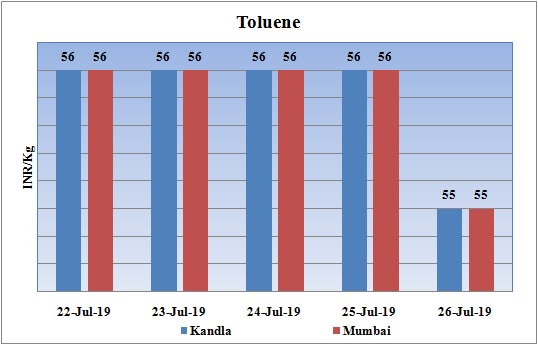

Toluene Weekly Report 26 July 2019

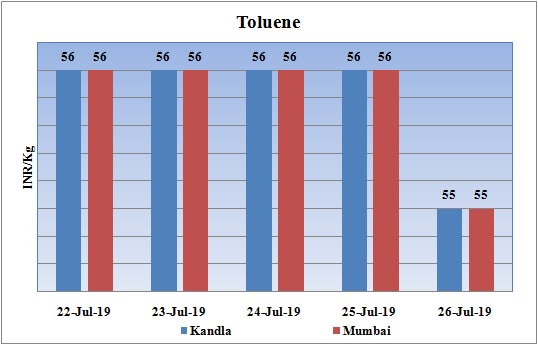

Weekly Price Trend: 22-07-2019 to 26-07-2019

- The above given graph focuses on the Toluene price trend for current week.

- This week prices remained volatile throughout this week. Prices reduced by end of the week. By end of the week prices were assessed at the level of Rs.55/Kg for bulk quantity for Kandla and for Mumbai ports of India.

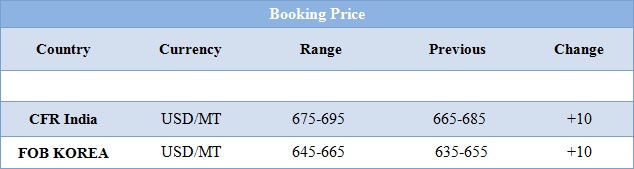

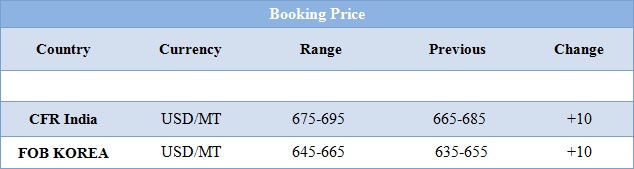

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market price was assessed at Rs.55/kg for bulk quantity increased by Rs.1/Kg in compare to last week’s closing values.

- CFR India prices were evaluated at USD 685/MT, increased by USD 10/MT for this week.

- CFR China price of toluene were assessed at the level of USD 685/MT, slightly increased by USD 5/MTS for this week. On other side FOB Korea prices were evaluated at USD 655/MT, increased by USD 10/MTS for this week.

- CFR south East Asia price were evaluated at USD 685/MT, increased by USD 5/MT for this week.

- Benzene the major source for aromatic products has reduced for this week. FOB Korea values for Benzene were assessed around USD655/MT, reduced by USD20/MT for this week, while CFR China prices also increased and were assessed at the level of USD 655/MT for this week.

- OPEC is considering using several metrics to assess where global oil (over)supply stands, including taking the five-year average of oil stocks in 2010-2014 instead of the most recent five-year average 2014-2018, which it currently reports in its monthly oil market reports and which the International Energy Agency (IEA) also takes as a benchmark to measure oil inventories.

- OPEC and its Russia-led non-OPEC allies are in their third year of managing supply to the market, hoping to draw down high inventories and push up oil prices.

- With demand rising over the next nine months and the commitments from all the countries, including the Kingdom of Saudi Arabia, we are approaching the normal levels of supplies of 2010-2014. It is one of the options in front of us as a goal.”

- The rate of the last five years is another option, which we think is unsuitable. We will study the middle options between these two choices. In any case, we will make sure that the market is balanced with proportionate indicators.

$ 1 = Rs. 68.92

Import Custom Ex. Rate USD/ INR: 69.65

Export Custom Ex. Rate USD/ INR: 67.95