Toluene Weekly Report 26 April 2019

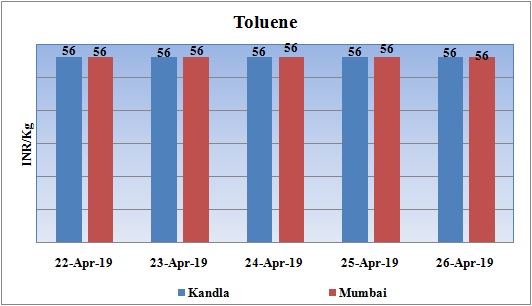

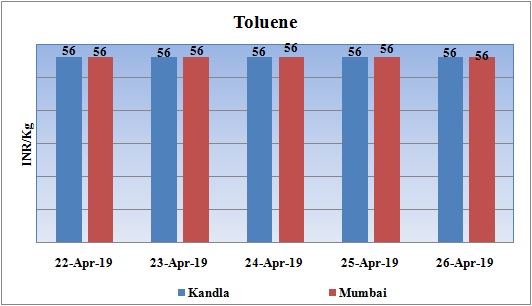

Weekly Price Trend: 22-04-2019 to 26-04-2019

- The above given graph focuses on the Toluene price trend for current week.

- This week prices remained stable and by end of the week there was no change in values comparing last week prices.

- By the end of the week domestic prices were assessed at Rs.56/Kg for bulk quantity for Kandla and for Mumbai ports of India.

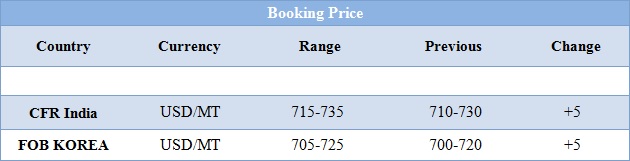

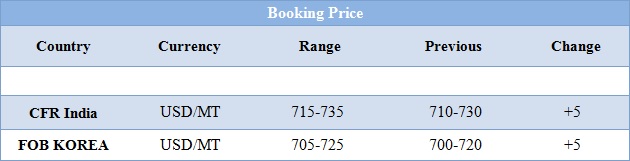

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs.56/kg for bulk quantity, increased by Rs.2/Kg for bulk quantity.

- CFR India prices were evaluated at USD 725/MT, improved by USD 5/MTS for this week.

- CFR China price of toluene were assessed at the level of USD 725/MT, increased by USD 15/MT for this week. On other side FOB Korea prices were evaluated at USD 715/MT, improved by USD 5/MT for this week.

- CFR south East Asia price were evaluated at USD 750/MT, increased by USD 10/MT for this week

- Benzene FOB Korea prices, this week again prices has increased consistently. FOB values were assessed around USD 6410/MT increased by USD 6/MT for this week. On other side CFR China prices for Benzene were assessed USD 636/MT, increased by USD 8/MT for this week.

- The election period going in the country has been major factor affecting the sentiments for Indian economy. Traders are in mood to know first about the government to take lead and then make any fresh position in the market.

- This week there has been continuous rise in oil prices in international market. Price rise has been in particularly due to end in the sanctions in waivers given by US against Iran to several other nations.

- India and China are the two major countries importing the most oil from Iran. Oil prices have rallied by more than two percent in this week in compare to closing of prices in the end of 2018. The grant provided to eight nations has now been pulled back by US.

- These potential disruptions to Iranian supplies add to an already tight market. The Organization of the Petroleum Exporting Countries (OPEC) has led supply cuts since the start of the year aimed at tightening global oil markets and to propping up crude prices.

$ 1 = Rs. 70.01

Import Custom Ex. Rate USD/ INR: 70.40

Export Custom Ex. Rate USD/ INR: 68.70