Toluene Weekly Report 23 Sep 2017

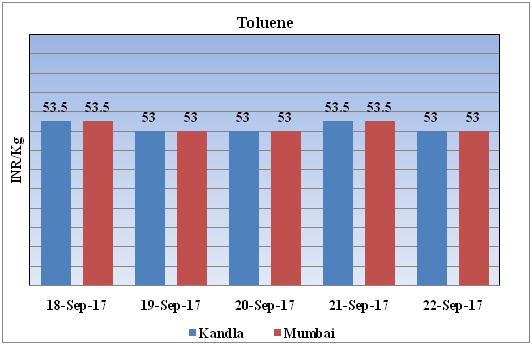

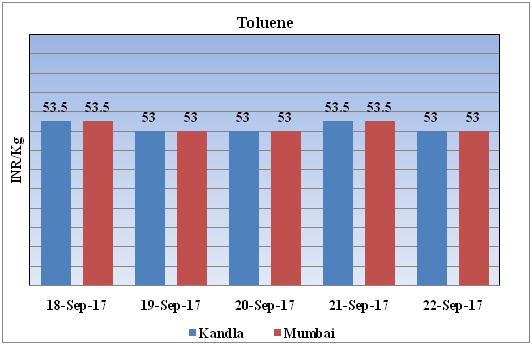

Weekly Price Trend: 18-09-2017 to 22-09-2017

- The above given graph focuses on the Toluene price trend for current week.

- This week prices have followed volatile trend. By the end of the week domestic prices were assessed at Rs 53Kg for bulk quantity for Kandla and Mumbai ports of India.

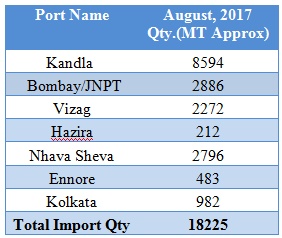

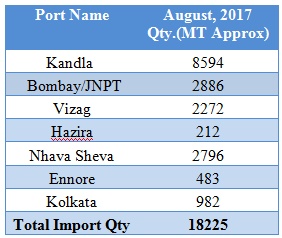

Total import at various ports of India August, 2017

Above chart represents the total imported quantity of Toluene for the month of August, 2017. Last month total imports were around 18225mt. As per chart at Kandla port imports were higher while at Ennore port import was lesser.

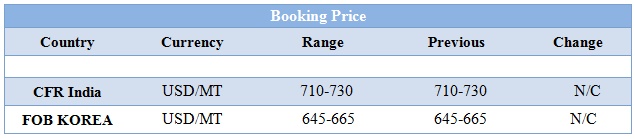

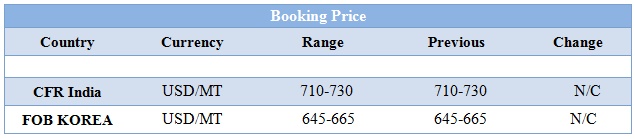

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs 53/kg for Kandla and Rs. 53/kg for Mumbai ports of India.

- CFR India prices were evaluated at USD 720/mt, prices have remained firm in compares to previous week.

- CFR China price of toluene were assessed at the level of USD 680/mt.

- FOB Korea prices were evaluated at USD 655/mt prices has remained firmin compare to previous week.

- This week domestic toluene prices have remained firm but demand has been growing on account of this it is anticipated that prices will go up.

- South China toluene prices increase on vessel restriction talks.

- Taiwan’s CPC Corp plans H2 Oct shutdown for No 3 aromatics unit.

- Toluene supplies in Europe have lesser after heavy exports to the US in previous weeks by producers.

- This week oil prices have followed mixed trend. Oil prices were steady on Thursday ahead of a meeting of oil producers that could extend production limits aimed at clearing a glut that has depressed the market for more than three years. As per report, Ministers from the OPEC, Russia and other producers meet in Vienna on Friday and are due to consider extending output cuts that began in January.

- On Thursday, closing crude values have mixed.WTI on NYME closed at $50.55/bbl, prices have decreased by $0.14/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.14/bbl in compared to last trading and was assessed around $56.43/bbl. Presently many analysts anticipate that OPEC to extend the deal, possibly to the end of next year.

$1 = Rs. 64.79

Import Custom Ex. Rate USD/ INR: 65.40

Export Custom Ex. Rate USD/ INR: 63.70