Toluene Weekly Report 22 Feb 2019

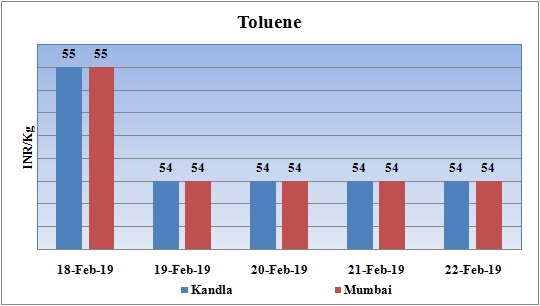

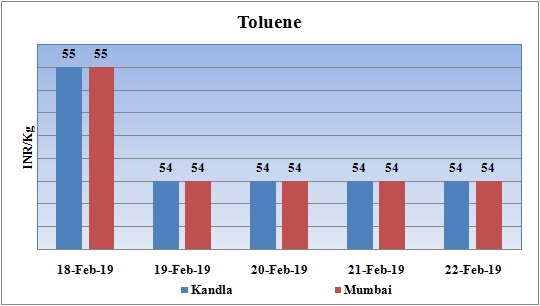

Weekly Price Trend: 18-02-2019 to 22-02-2019

- The above given graph focuses on the Toluene price trend for current week.

- This week prices remained soft-to stable firm and there has been decline in values. By the end of the week domestic prices were assessed at Rs.54/Kg for bulk quantity for Kandla and for Mumbai ports of India.

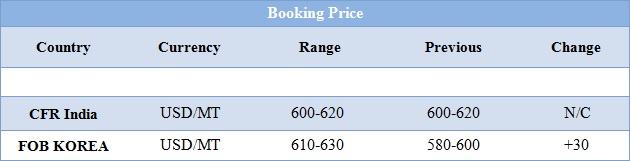

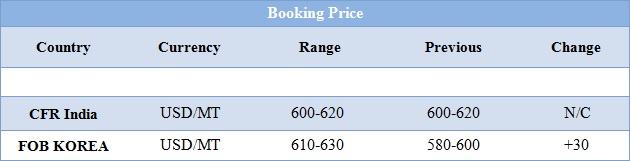

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs.54/kg for Kandla and for Mumbai ports of India.

- CFR India prices were evaluated at USD 610/MT, with no change on compare to last week’s closing value.

- CFR China price of toluene were assessed at the level of USD 640/MT, increased by USD20/MT for this week.

- FOB Korea prices were evaluated at USD 620/MT, increased by USD 30/MT in compare to previous week.

- CFR south East Asia price were evaluated at USD 635/MT. Benzene FOB Korea prices remained soft-to-stable for this week. FOB Korea values were assessed around USD 620/MT. On other side CFR China prices for Benzene were assessed USD 630/MT for this week.

- The recent terror attack on Indian military will have an adverse impact on Indian trade relation with neighboring nation. Moreover such heinous attacks affect the economy of the country as well.

- US crude has hit a new high in production this week. Prices on back of this production has hit to bottom despite of OPEC trying to withhold the production and tighten global markets.

- International Brent crude futures were at $66.87 per barrel at 0326 GMT, down 20 cents, or 0.3 percent, from their last close. U.S. West Texas Intermediate (WTI) crude oil futures were at $56.84 per barrel, down 12 cents, or 0.2 percent, from their last settlement.

- U.S. crude output has soared by almost 2.5 million bpd since the start of 2018, and by a whopping 5 million bpd since 2013. America is the only country to ever reach 12 million bpd of production.

- OPEC and some non-affiliated producers such as Russia agreed late last year to cut output by 1.2 million bpd to prevent a large supply overhang from growing. Another recent price driver has been U.S. sanctions against osil exporters Iran and Venezuela.

PLANT NEWS

CNOOC Taizhou postpones its maintenance for its aromatic unit

- CNOOC Taizhou postpones its maintenance for its aromatic unit. The delay has been carried out for its 1 mln mt/year reformer and aromatics plant to second half of 2019. The exact timing was not settled yet. The company originally planned to shut the reformer and aromatics plant in mid-Feb for about 30-40 days. Taizhou Petrochemical's aromatics plant has the capacity to produce 70kt/year of benzene, 175kt/year of toluene and 220kt/year of mixed xylenes.

$ 1 = Rs. 71.14

Import Custom Ex. Rate USD/ INR: 72.00

Export Custom Ex. Rate USD/ INR: 70.30