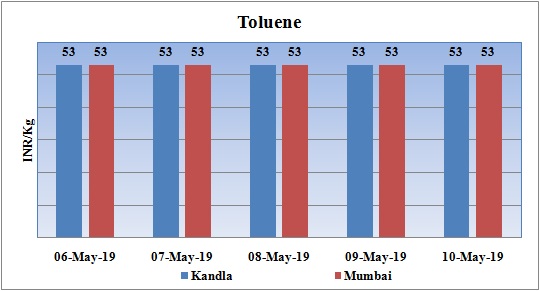

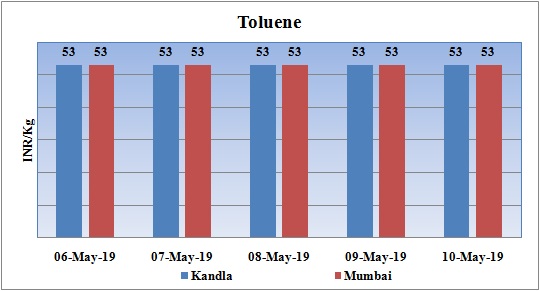

Toluene Weekly Report 10 May 2019

Weekly Price Trend: 06-05-2019 to 10-05-2019

- The above given graph focuses on the Toluene price trend for current week.

- This week prices remained stable and by end of the week there was no change in values comparing last week prices.

- By the end of the week domestic prices were assessed at Rs.53/Kg for bulk quantity for Kandla and for Mumbai ports of India.

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs.53/kg for bulk quantity, reduced by Rs.2/Kg for bulk quantity.

- CFR India prices were evaluated at USD 680/MT, reduced by USD 20/MTS for this week.

- CFR China price of toluene were assessed at the level of USD 675/MT, reduced by USD 25/MT for this week. On other side FOB Korea prices were evaluated at USD 665/MT, reduced by USD 20/MT for this week.

- CFR south East Asia price were evaluated at USD 730/MT, remained unchanged for this week.

- Benzene FOB Korea prices, this week has reduced significantly for this week. FOB values were assessed around USD 620MT reduced by USD 5/MT for this week. On other side CFR China prices for Benzene were assessed USD 614/MT, lesser by USD 10/MT for this week.

- Crude oil prices are heading on higher note since last few weeks following first day of US-China trade talks. Sentiment got an uptick following a report that Trump, Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer were talking about progress in negotiations. The fate of the commodity, and whether or not gains may last likely depends on the outcome of the negotiations.

- The end of the U.S. sanction waivers for all Iranian all buyers means that Iran’s oil exports will drop as of this month, but no one is really sure by how much. Various analysts expect that Iran will continue to ship oil somewhere between 200,000 bpd and 600,000 bpd, but not all that oil would be oil sales as it could be debt repayment, and some of it is expected to go ‘under the radar’.

- All these uncertainties in oil supply are making OPEC’s decision making more difficult as the cartel and allies are getting ready to hold a panel of technical committees later this month in Jeddah, Saudi Arabia, to discuss the state of the oil market and the supply and demand balance.

$ 1 = Rs. 69.91

Import Custom Ex. Rate USD/ INR: 70.45

Export Custom Ex. Rate USD/ INR: 68.80