Styrene Monomer Weekly Report 8 Feb 2019

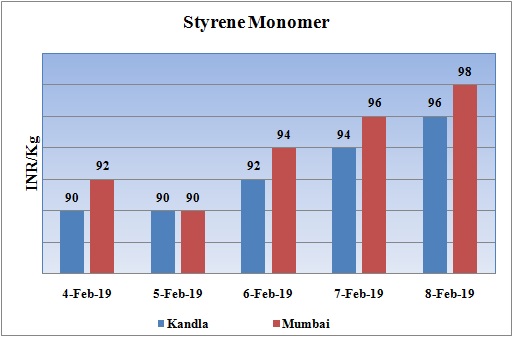

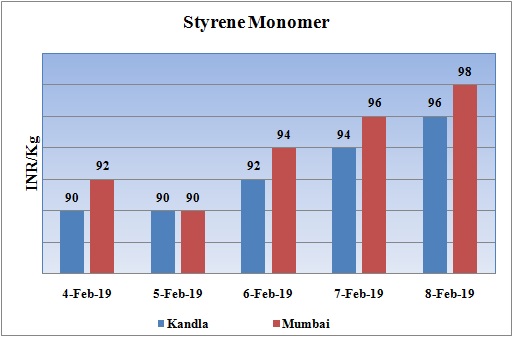

Weekly Price Trend: 04-02-2019 to 08-02-2019

- If we take a quick look at the above given weekly prices, it can be observed that for the current week prices of Styrene Monomer has increased heavily for this week.

- On Friday domestic values were assessed around Rs.96/Kg for bulk quantity at Kandla and Rs. 98/kg for Mumbai ports of India.

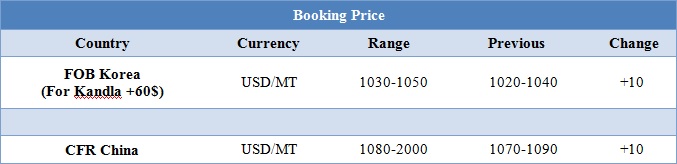

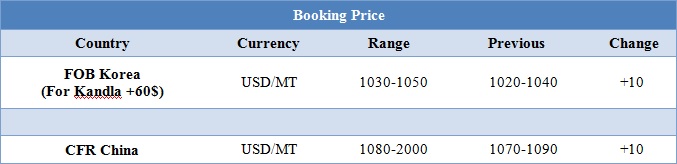

Booking Price

INDIA& INTERNATIONAL

- The domestic prices of Styrene were assessed at the level of Rs.96/Kg for Kandla and Rs 98/kg Mumbai ports.

- FOB Korea values for Styrene were assessed around USD 1040/M increased by USD 10/MT for this week. On other side CFR China prices also decreased by USD 1080/MT, increased by USD 10/MT in compare to last week’s closing values.

- South East Asia prices of SM were evaluated at USD 1050/MT. Here also improvement in the values was observed.

- Benzene FOB Korea prices also remained firm and strong for this week. FOB Korea values were assessed around USD 600/MT. On other side CFR China prices were assessed around USD 605/MT for this week.

- Moreover the ongoing Lunar vacation in China has also slowed down the trade and trading in international market.

- International prices for Methanol for this week were assessed around USD 305/MT increased by USD 15/MT for this week. Methanol values remained flat in China market.

- Benchmark Brent oil inched up on Friday but was heading for a weekly loss, pulled down by worries about a global economic slowdown, although OPEC-led supply cuts and U.S. sanctions against Venezuela provided crude with some support.

- U.S. President Donald Trump said on Thursday that he did not plan to meet Chinese President Xi Jinping before a March 1 deadline set by the two countries to strike a trade deal.

- Adding to demand concerns, the European Commission sharply cut its forecasts for euro zone economic growth due to global trade tensions and an array of domestic challenges.

- Supply cuts led by the Organization of the Petroleum Exporting Countries lent support. OPEC kingpin Saudi Arabia reduced its output in January by about 400,000 barrels per day (bpd) to 10.24 million bpd, OPEC sources said.

- Another risk to supply comes from Venezuela after the implementation of U.S. sanctions against the OPEC member's petroleum industry in late January. Analysts expect this move to knock out 300,000-500,000 bpd of exports.

$1 = Rs. 71.18

Import Custom Ex. Rate USD/ INR: 72.65

Export Custom Ex. Rate USD/ INR: 70.95