Styrene Monomer Weekly Report 22 Sep 2018

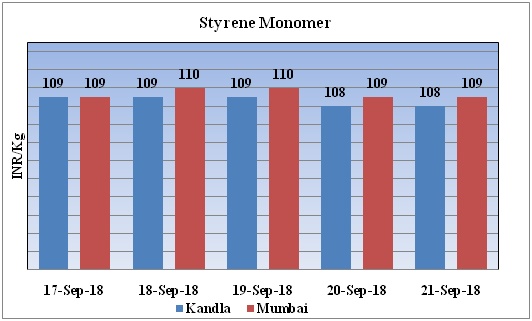

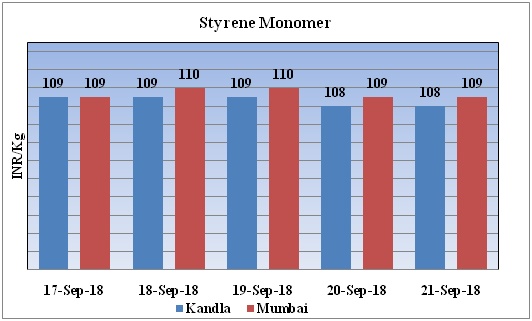

Weekly Price Trend: 17-09-2018 to 21-09-2018

If we take a quick look at the above given weekly prices, it can be observed that for the current week prices of Styrene Monomer have decreased at Kandla and at Mumbai ports and at the end of the week prices were assessed Rs.108/Kg for bulk quantity at Kandla and Rs 109/kg for Mumbai ports of India.

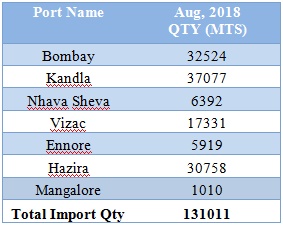

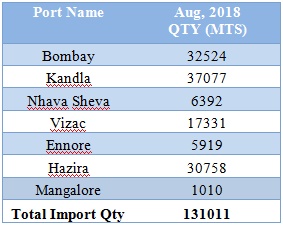

Total import at various ports of India August, 2018

Above graph represents the imported quantity of Styrene Monomer for the month of August. Last month total imports were around 131011MT.

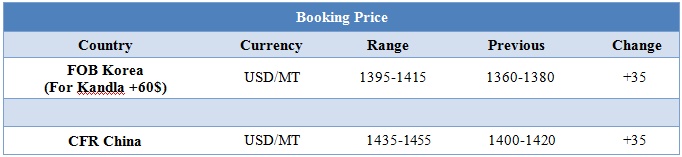

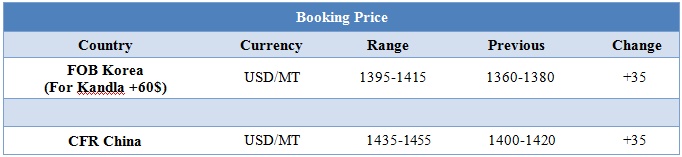

Booking Price

INDIA& INTERNATIONAL

- The domestic prices of Styrene were assessed at the level of Rs.108/Kg for ex Kandla and Rs 109/kg Mumbai ports.

- This week International SM prices have decreased on bearish demand sentiments.

- Styrene prices increased on tight supply and lower imports.

- South East Asia prices of Sm were evaluated at USD 1410/mt.

- CFR India SM prices were evaluates at USD 1415/mt.

- Currently domestic styrene prices were assessed at the level of Rs 111/kg for imported tanker load and Rs 119/kg for imported repack in Mumbai. On account of volatility in supply of the material, traders were forced to revise SM prices upwards.

- Taiwan’s July SM exports fall 44.8% on month.

- Indonesia's SMI shuts SM plant for turnaround.

- As per source, the strong dependency on imports due to the limited domestic production, global market prices, and currency fluctuations are the major constraints for the Indian styrene market.

- Despites significant production capacity for Benzene in India, there isn't any installed production capacity for Styrene Monomer in the country. As such, the bulk prices in India are completely reliant on international prices and exchange rate fluctuations.

- According to the market participants presently the demand for Styrene is good from the resin and paint industries.

- Crude prices are making new heights. On Thursday prices slightly eased with US president urging OPEC to bring prices down. Experts believe that Brent will soon cross the mark of USD 80 after gap of four years. US President would least want the crude prices to go high with mid election in next few months.

- The Iranian sanctions are making hard for the Asian countries which are the consumers of Iranian crude. Many buyers have already cut Iranian purchases ahead of the new regulations. It is unclear whether producers such as Saudi Arabia, Iraq and Russia can compensate for lost supply.

- This week benzene prices have decreased.

- East China benzene inventories drop to 162,200 tonnes.

- As per report, Benzene prices will remain bearish due to an increase in supply for October and November.

- FOB Korea and CFR China prices of Benzene were evaluated at USD 845/mt and USD 850/mt respectively.

$1 = Rs. 72.19

Import Custom Ex. Rate USD/ INR: 73.65

Export Custom Ex. Rate USD/ INR: 71.95