Styrene Monomer Weekly Report 19 April 2019

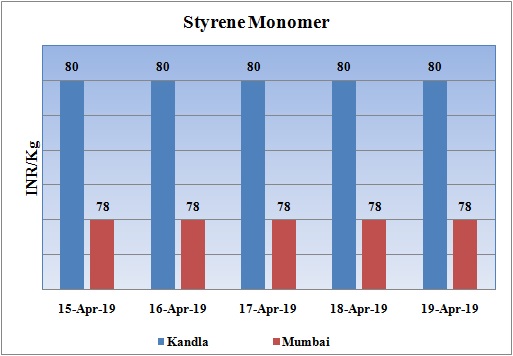

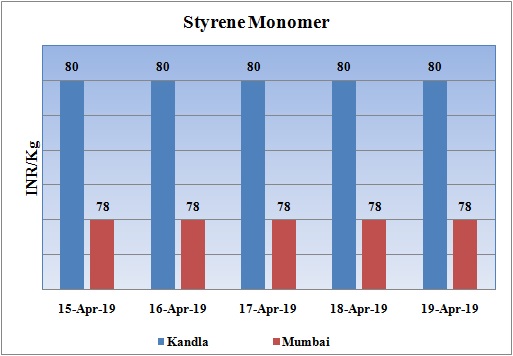

Weekly Price Trend: 15-04-2019 to 19-04-2019

- If we take a quick look at the above given weekly prices, it can be observed that for the current week prices of Styrene Monomer has remained stable but it has declined from last week’s closing prices.

- On Friday domestic values were assessed around Rs.80/Kg for bulk quantity at Kandla and Rs.82/kg for Mumbai ports of India reduced by Rs.2/Kg for bulk quantity.

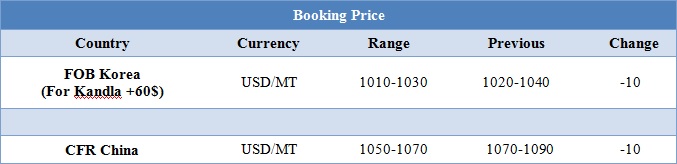

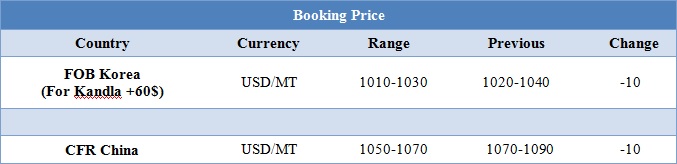

Booking Price

INDIA& INTERNATIONAL

- The domestic prices of Styrene were assessed at the level of Rs.80/Kg for Kandla and Rs 82/kg Mumbai ports. Domestic prices have reduced by Rs.2 for both the ports.

- On other side, FOB Korea values for Styrene were assessed around USD 1010-1030/MT, reduced by USD 10/MT in this one week. On other side CFR China prices also reduced by USD 10/MT for this week and were assessed at the levels of USD 1060/MT for this week. South East Asia prices of SM were evaluated at USD 1060/MT.

- Benzene FOB Korea prices has again witnessed rise in international prices. Values were assessed at the level of USD 636/MT increased by USD 6/MT in one week. On other side CFR China prices were assessed around USD 628/MT for this week.

- The election period going in the country has been major factor affecting the sentiments for Indian economy. Traders are in mood to know first about the government to take lead and then make any fresh position in the market.

- Crude has been on upward trajectory since past few weeks, but with slowdown in buying has led to correction in values.

- The renewed concerns over rising US inventory and production as well as concerns over a global economic slowdown helped put a lid on the prices.

- On the demand front, China’s state-owned energy giant Sinopec had resumed buying US oil, which was bullish for the market. The EIA reported that US crude exports to China had dried up from mid-2018 through recent weeks, after having averaged over 300,000 bpd in first half of last year.

- Lanzhou Petrochemical is planning to shutdown its Ethylene cracker for maintenance turnaround. The unit is likely to go off-stream on 25th April and will remain off-stream for around 6-7 weeks. Unit is based at Lanzhou in Gansu province of China and has the production capacity of 4,60,000 mt/year.

$1 = Rs. 69.35

Import Custom Ex. Rate USD/ INR: 70.40

Export Custom Ex. Rate USD/ INR: 68.70