Styrene Monomer Weekly Report 14 April 2018

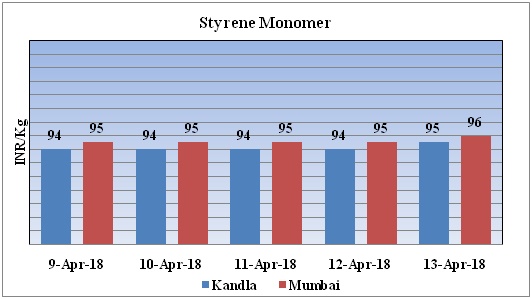

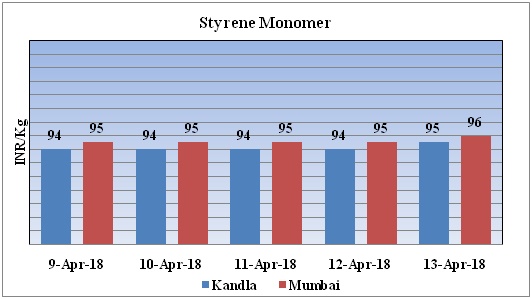

Weekly Price Trend: 09-04-2018 to 13-04-2018

If we take a quick look at the above given weekly prices, it can be observed that for the current week prices of Styrene Monomer have escalated at Kandla port in compare to previous week and at the end of the week prices were assessed Rs.95/Kg for bulk quantity at Kandla and Rs 96/kg for Mumbai ports of India.

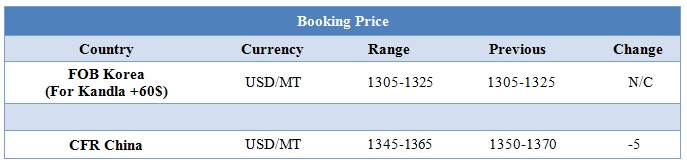

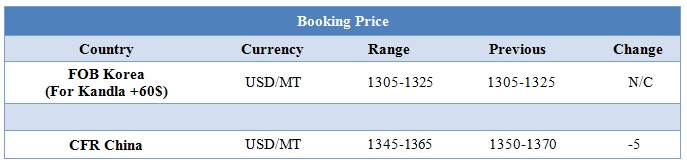

Booking Price

INDIA& INTERNATIONAL

- The domestic prices of Styrene were assessed at the level of Rs.95/Kg for ex Kandla and Rs 96/kg Mumbai ports.

- CIF India prices were assessed at the level of USD 1370/MT.

- This week SM prices have escalated on increase in energy value.

- The Asian styrene market is expected to remain on an uptrend this week, especially for prompt loading cargoes.

- East China inventories plunged and strong restocking demand emerging from downstream ABS makers in East China which has resulted increase in prices.

- East China SM stocks held by traders were estimated at 70,800 mt.

- Feedstock benzene prices have remained firm in Asian market this week.

- FOB Korea and CFR China prices of Benzene were evaluated at USD 835/mt and USD 835/mt respectively.

- Oil prices have escalated through the week but on Thursday prices have remained mixed.

- On Thursday, closing crude values have mixed. WTI on NYME closed at $67.07/bbl; prices have increased by $0.25/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.40/bbl in compared to last trading and was assessed around $72.02/bbl.

- Oil markets remained tense on Thursday on concerns over a military escalation in Syria, although prices were some way off Wednesday's late-2014 highs as bulging U.S. supplies weighed. A trade dispute between the United States and China also kept markets on edge.

- Crude oil prices settled at three-year highs amid ongoing expectations that geopolitical tensions in the Middle East could add a possible ‘fear premium’ to oil, while continued OPEC cuts supported sentiment.

- If the U.S. does indeed launch missiles at Syria, this would heighten risk and likely at once push crude oil higher and depress equities further.

$1 = Rs. 65.20

Import Custom Ex. Rate USD/ INR: 65.90

Export Custom Ex. Rate USD/ INR: 64.20