Styrene Monomer Weekly Report 02 Dec 2017

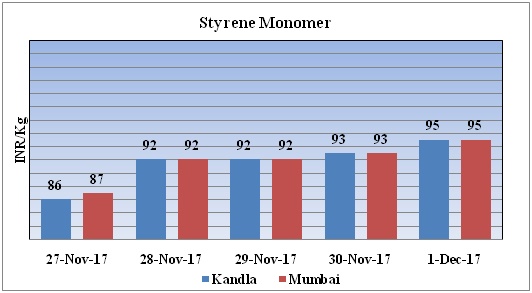

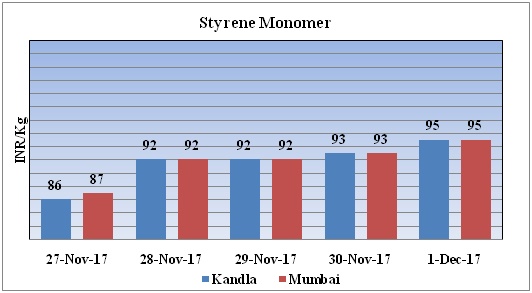

Weekly Price Trend: 27-11-2017 to 01-12-2017

- If we take a quick look at the above given weekly prices, it can be observed that for the current week prices of Styrene Monomer have followed upward trend in compare to previous week and at the end of the week prices were assessed Rs.95/Kg for bulk quantity at Kandla and Rs 95/kg for Mumbai ports of India.

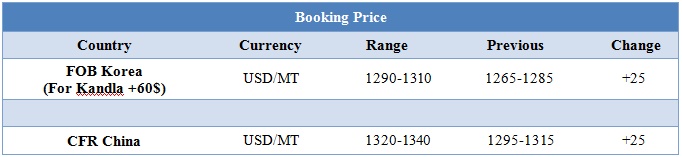

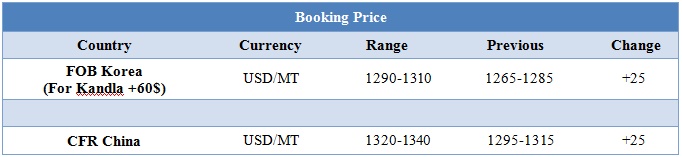

Booking Price

INDIA& INTERNATIONAL

- The domestic prices of Styrene were assessed at the level of Rs.95/Kg for ex Kandla and Rs 95/kg Mumbai ports.

- CIF India prices were assessed at the level of USD 1300/MT.

- This week FOB Korea prices were assessed USD 1300/MTS prices have increased in compared to last week’s closing prices.

- SM Prices increased sharply on account of rising energy prices, strong feedstock benzene costs and bullish buying interest in Asia market

- Maintenance for SM plant has been announced by Grand Pacific Petrochemical Corp (GPPC). Grand Pacific Petrochemical Corp (GPPC) is likely to shut its styrene monomer (SM) plant for a maintenance turnaround. The unit is likely to go off-stream in mid-April 2018. The unit is expected to remain off-stream for around one month. Unit is based at Kaohsiung in Taiwan and has the manufacturing capacity of 2, 50,000 mt/year.

- This week crude oil prices have followed mixed trend. On Thursday oil prices have escalated OPEC members, Russia and nine other producers agreed to extend a deal to limit their production through 2018.

- On Thursday, closing crude values have increased. WTI on NYME closed at $57.40/bbl; prices have decreased by $0.10/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.46/bbl in compared to last trading and was assessed around $63.57/bbl.

- As per report, the producers will indeed review the deal at the next OPEC meeting in June. Some market were concerned that a nine-month extension could cause markets to quickly tighten, leading to undersupply that results in a price spike.

- Feedstock benzene prices have increased in Asian market this week.

- FOB Korea and CFR China prices of Benzene were evaluated at USD 880/mt and USD 885/mt respectively.

$1 = Rs. 64.46

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50