Phenol Weekly Report 8 March 2019

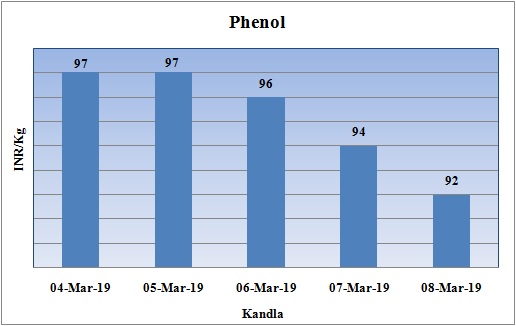

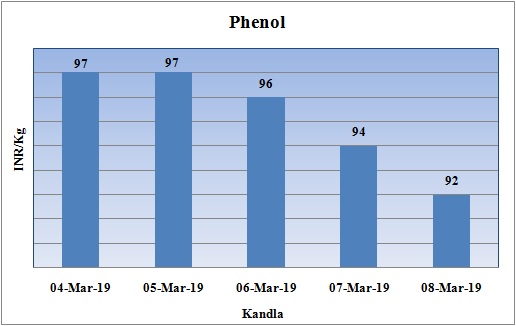

Weekly Price Trend: 04-03-2019 to 08-03-2019

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price trend remained highly vulnerable and has been turbulent for this week.

- By end of the week prices were assessed at the level of Rs. 92/Kg for bulk quantity. Prices have reduced significantly in domestic market. The fall in values is on back of plenty of supply in the domestic market.

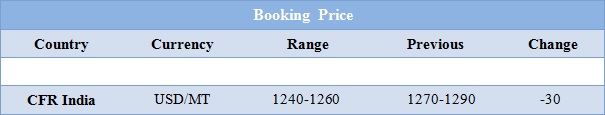

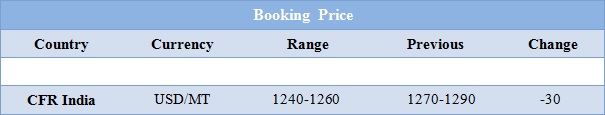

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.92/Kg for bulk quantity.

- CFR India prices for this week were assessed in the range of USD 1204-1260/MTS, reduced by USD 30/MTS for this week.

- Benzene the major source for Phenol has also reduced for this week. Benzene FOB Korea prices were assessed at the level of USD 619/MT. On other side CFR China prices were assessed at the level of USD 624/MT, slightly improved by USD 4/MT for this week.

- U.S. West Texas Intermediate (WTI) crude oil futures were at $56.32 per barrel, down 34 cents, or 0.6 percent, from their last settlement.

- Brent crude oil futures were at $65.83 per barrel at 0358 GMT, down 47 cents, or 0.7 percent from their last close.

- Financial markets, including crude oil futures, took a hit after ECB President Mario Draghi said on Thursday the economy was in "a period of continued weakness and pervasive uncertainty".

- China's February dollar-denominated exports fell 21 percent from a year earlier, coming in far worse than analysts' expectations, while imports dropped 5.2 percent, official data showed on Friday.

- Russia has bagged to become the major exporter of crude to US after Venezuela sanctions. U.S. crude oil imports from Venezuela slumped to just 83,000 bpd in the week to March 1, compared to 208,000 bpd in the previous week.

- The U.S. sanctions on Venezuela have also prohibited U.S. exports of naphtha to the Latin American country which uses the product to dilute its heavy crude. SO here again Russia has came to rescue for these nations. Rosneft has carried out shipments of heavy naphtha to Venezuela expected in the next few weeks.

$1 = Rs. 69.91

Import Custom Ex. Rate USD/ INR: 71.00

Export Custom Ex. Rate USD/ INR: 69.30