Phenol Weekly Report 4 October 2019

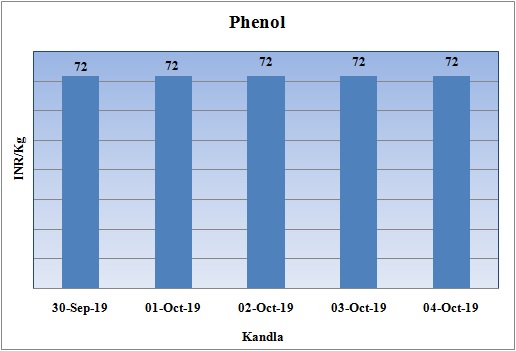

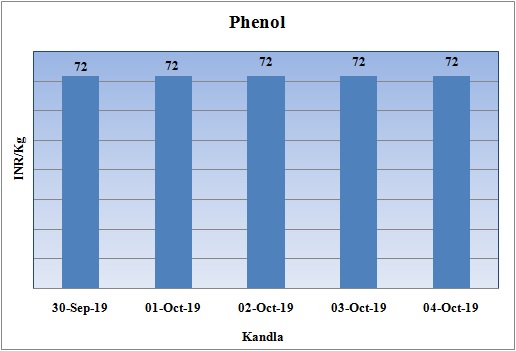

Weekly Price Trend: 30-09-2019 to 04-10-2019

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price remained stable throughout this week. By end of the week prices were assessed at the level of Rs. 72/Kg for bulk quantity.

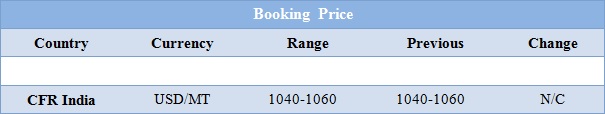

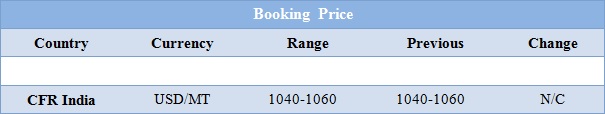

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.72/Kg for bulk quantity. Prices remained stable with no change in values for this week.

- CFR India prices for this week were assessed in the range of USD 1020-1040/MTS, with no change in values for this week in compare to last week’s closing values.

- Most of the markets in India are also operating rate festive season is celebrated across the country.

- Benzene is the major raw material for Phenol production. Benzene the major source for aromatic products also remained unchanged for this week. FOB Korea values for Benzene were assessed around USD 720/MT for this week, while CFR China prices were assessed at the level of USD 730/MT for this week.

- Demand for Benzene has remained stable as most of Chinese manufacturers are away from market. Some participants expect demand to remained unaffected as US-China trade tensions are likely to soar up again.

- China is celebrating its Golden week festival next week. So most of Chinese markets are not available and will resume work from next week.

- There have been significant changes across the global market affecting the demand for petrochemicals.

- Global auto market has been at its lowest phase affecting the chemical sector associated with automobile sector.

- Global economic factor i.e. slowdown in economies, liquidity crunch and the political differences between China and US has been hampering the global trade and has been making it more polarized. The US$ has been rising due to increased uncertainty, creating currency risk for those who have borrowed in dollars; geopolitical risks are becoming more obvious.

- Chemical industry capacity utilization, the best leading indicator for the global economy, has been in decline since December 2017, leading to conclusion of recession in near future and the bankruptcies among over-leveraged firms will inevitably increase.

- On Thursday, closing crude values have mixed. WTI on NYME closed at $52.45/bbl. Prices have decreased by 0.19/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 0.02/bbl in compare to last closing price and was assessed around $57.71/bbl.

$1 = Rs. 70.96

Import Custom Ex. Rate USD/ INR: 72.15

Export Custom Ex. Rate USD/ INR: 70.45