Phenol Weekly Report 29 March 2019

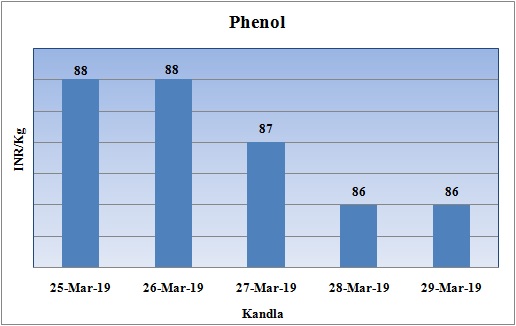

Weekly Price Trend: 25-03-2019 to 29-03-2019

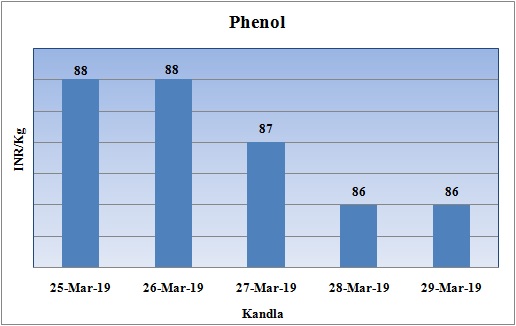

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price trend remained highly vulnerable and has been turbulent for this week.

- By end of the week prices were assessed at the level of Rs. 86/Kg for bulk quantity. Prices have reduced significantly in domestic market. This week domestic values have reduced by Rs.6/Kg for bulk quantity. The fall in values is on back of plenty of supply in the domestic market.

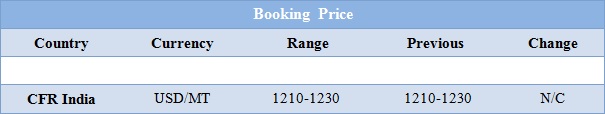

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.86/Kg for bulk quantity. Prices reduced by Rs.2/Kg for bulk quantity.

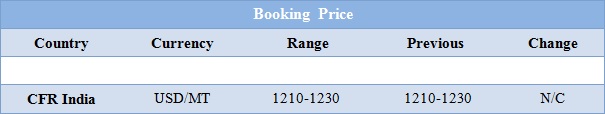

- CFR India prices for this week were assessed in the range of USD 1210-1230/MTS, with no change in compare to last week’s closing values.

- Benzene the major source for Phenol had decline abruptly for this week. Benzene FOB Korea prices were assessed at the level of USD 535/MT, reduced by USD 90/MT for this week. On other side CFR China prices were assessed at the level of USD 545/MT, reduced by USD 75/MT for this week.

- China has decided to continue its imposition of anti dumping duties on nonyl Phenol imports from Taiwan and India. China has extended its anti-dumping duties (ADD) on imports of nonyl phenol from Taiwan and India for another five years.

- This is the second time that the five-year ADDs were extended following a one-year review. The trade measure was first introduced on 29 March 2007.

- “The one-year review concluded that ADD would still be necessary to prevent dumping,” the ministry said.Nonyl phenol is mainly used in the production of surfactants and additives.

- There have been constant fluctuation include prices in international market. US has been worried for the formation of new Middle East bloc comprising of Turkey, Iran and Qatar.

- These nations are already in black list of US, now with strong connection among these countries the trigger is felt by the US government.

- There is one more thing which could derail the oil supplies of US. The quality issue with crude has been a big headache for the manufacturers. Recently two leading Korea importers have cancelled their order for crude from US. Reason behind this declining quality is that there is a massive pipeline network carrying crude oil from the U.S. shale patch to the Gulf Coast ports where it is loaded on tankers and sent to Asia, with South Korea emerging as the biggest buyer of U.S. crude so far this year.

- Yet with so many pipelines—trunks and branches—the oil gets contaminated with various undesirable things, from oil residue to heavy metals, pipe cleaning agents, and a group of compounds called oxygenates. These last ones are particularly worrying for refiners, it seems.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $59.30/bbl. Prices have decreased by $0.11/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.01/bbl in compare to last closing price and was assessed around $67.82/bbl.

$1 = Rs. 69.21

Import Custom Ex. Rate USD/ INR: 70.00

Export Custom Ex. Rate USD/ INR: 68.35