Phenol Weekly Report 27 September 2019

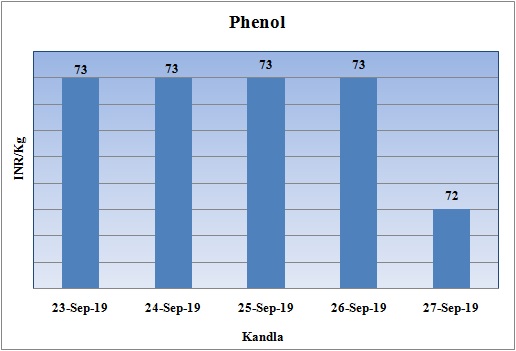

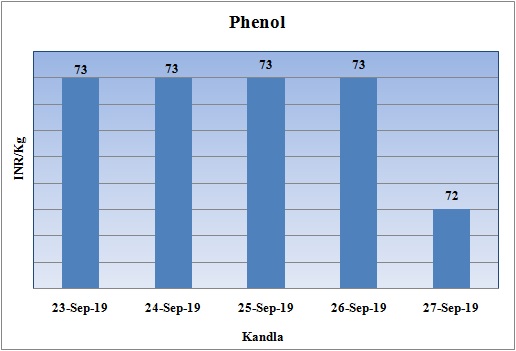

Weekly Price Trend: 23-09-2019 to 27-09-2019

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price remained variable throughout this week. By end of the week prices were assessed at the level of Rs. 72/Kg for bulk quantity.

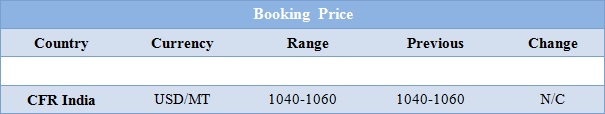

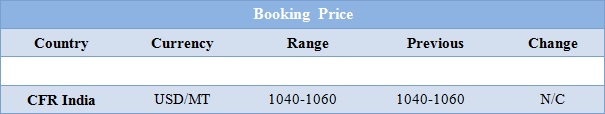

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.72/Kg for bulk quantity. Prices reduced slightly for this week and were assessed at the level of Rs.72/Kg for this week.

- CFR India prices for this week were assessed in the range of USD 1020-1040/MTS, with no change in values for this week in compare to last week’s closing values.

- Many of the China based units has shut down their BPA units for maintenance with restart after Golden week celebration. Beijing Yanshan Petrochemical shut two phenol units with a combined capacity of 185,000 tonnes/year has shut down its unit this week.

- China will be celebrating its Golden week festival next week. So prior to this most of Chinese markets are in mood to wind up their activities and to make fresh deals only after mini vacation.

- Nantong Xingchen will shut down its Bis Phenol A unit for maintenance turnaround. The unit is likely to remain off-stream for around three weeks. Unit will undergo maintenance in late October. Unit based at China and has the production capacity of 50,000 tonnes/year.

- The major manufacturers will be opting for either shutdown or , cutbacks and restricted highway transportation. Overall there will be completed silence from China market and very limited enquiries will be heard for next week.

- Benzene the major source for aromatic products also remained unchanged for this week. FOB Korea values for Benzene were assessed around USD 720/MT for this week, while CFR China prices were assessed at the level of USD 730/MT for this week.

- Oil prices fell on Friday, erasing more of the gains realized after the Sept. 14 attacks on Saudi Arabian oil facilities, as the rapid return of production capacity from the world’s top exporter squashed risk premiums.

- For most of the week the market has been trading lower as oil bulls have been discouraged by the quicker-than-expected return of Saudi oil output.

- Saudi Arabia had brought its production capacity back to 11.3 million barrels per day (bpd) less than two weeks after the attacks on it oil facilities, sources briefed on the matter told Reuters this week.

- The attacks, which knocked out 5.7 million bpd of production, initially sent oil prices up 20% although they dropped soon after as the kingdom pledged to bring back output by the end of September.

$1 = Rs. 70.61

Import Custom Ex. Rate USD/ INR: 72.20

Export Custom Ex. Rate USD/ INR: 70.50