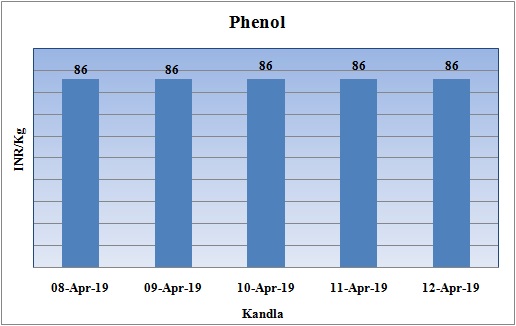

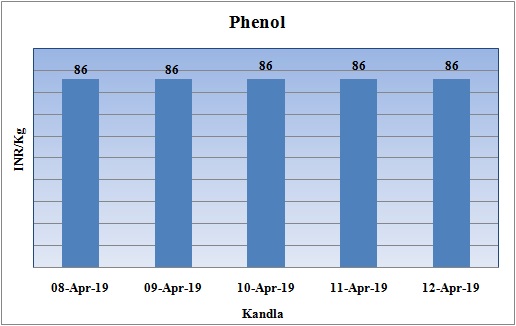

Phenol Weekly Report 12 April 2019

Weekly Price Trend: 08-04-2019 to 12-04-2019

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price trend remained highly vulnerable and has been turbulent for this week.

- By end of the week prices were assessed at the level of Rs. 86/Kg for bulk quantity.

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.86/Kg for bulk quantity. Prices remained unchanged for this week for bulk quantity.

- CFR India prices for this week were assessed in the range of USD 1070-1090/MTS, reduced by USD 70/MTS in compare to last week’s closing values.

- Weakening of values has been attributed to poor sentiment across Asia. Reduced demand from downstream segment in china has also affected the production of Phenol in Asia.

- Benzene the major source for Phenol had decline abruptly for this week. Benzene FOB Korea prices were assessed at the level of USD 700/MT, again recovered by USD 25/MTS from last week crash in the prices.

- On other side CFR China prices were assessed at the level of USD 705/MT, increased by USD 25/MTS for this week.

- China has decided to continue its imposition of anti dumping duties on nonyl Phenol imports from Taiwan and India. China has extended its anti-dumping duties (ADD) on imports of nonyl phenol from Taiwan and India for another five years.

- US market is likely to witness higher values for Phenol in this month. Recovering of Benzene pr ices last week is likely to put an upward pressure on Phenol prices in the US market. Supply has been very tight in North America through the first quarter and will remain so through this month. INEOS Phenol has curtail its production on back of fire in ITC as it has affected the production over there. AdvanSix and Altivia are the other major units shut down due to force majeure. Experts believe this scenario will last at least for this month.

- US President is trying hard to completely cut off imports from Iran. Soon it will take the decision of complete shutting of waiver provided to other five nations. This complete hold off will choke the supply of crude in international market and will push up the prices.

- Since the cost of U.S. crude oil has jumped 12%, international Brent crude is trading above $70 a barrel, and the national average gasoline price is up 30 cents a gallon.

- The primary reason for the run-up is simple: The market is tightening. That means a global oversupply of crude is draining, bringing supply and demand into balance and putting the market at risk of flipping into shortage.

- Venezuelan crude production has dropped below 1 million barrels per day (bpd) due to U.S. sanctions, the International Energy Agency said on Thursday, even below the 960,000 bpd OPEC reported on Wednesday.

PLANT NEWS

Phenol/Acetone unit shut down by Sinopec Yanshan

- Sinopec Yanshan Company Beijing has shut down its Phenol/acetone unit for maintenance turnaround. The unit will be shut down by end of this week and is likely to remain off-stream for around one week.

- Unit is based at Beijing in China and has the production capacity of Phenol around 1,10,00 tonnes/year and Acetone around 70,000 tonnes/year.

$1 = Rs. 69.27

Import Custom Ex. Rate USD/ INR: 69.45

Export Custom Ex. Rate USD/ INR: 67.75