Phenol Weekly Report 10 June 2017

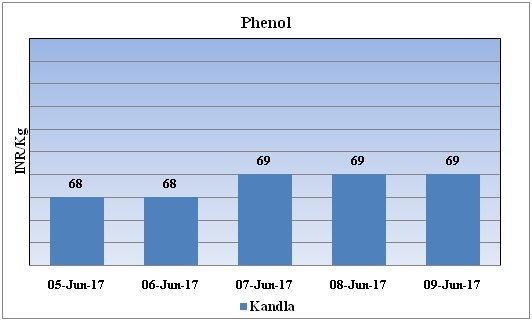

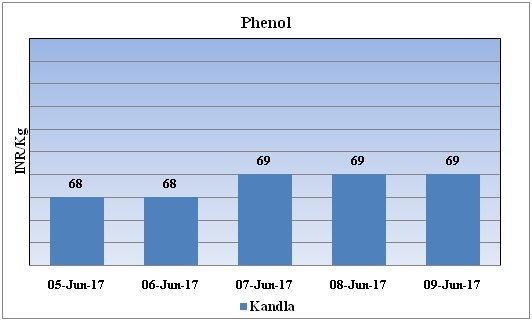

Weekly Price Trend: 05-06-2017 to 09-06-2017

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price trend it can be observed that this week domestic market prices of Phenol have increased and at the end of the week were assessed at the level of Rs. 69/Kg for bulk quantity.

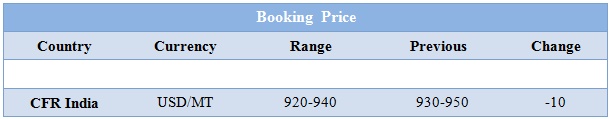

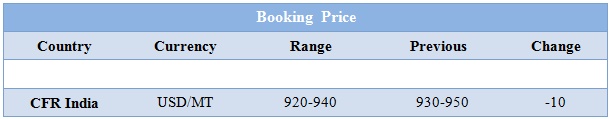

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market prices were assessed around Rs.69/Kg for bulk quantity. Prices have increased.

- CFR India prices for this week were assessed in the range of USD 920-940/MTS, prices have decreased in compared to last assessed values.

- This week domestic phenol prices have increased on little increase in demand sentiments.

- Thailand’s PTT Phenol plans BPA plant turnaround in July.

- Presently phenol market is moving with weak velocity demand sentiments has been weaker for bulk quantity.

- This week crude oil prices followed volatile trend with downward velocity. On Thursday oil prices fell due to an unexpected surge in U.S. inventories from signs of rising output in Libya and Nigeria to the crude market, as two OPEC members exempt from production cuts.

- WTI on NYME closed at $45.64/bbl, prices have decreased by $0.08/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.20/bbl in compared to last trading and was assessed around $47.86/bbl. On Friday oil prices stabilized due to steep falls earlier this week, but still pressured by evidence of an ongoing fuel glut despite efforts led by OPEC to tighten the market by holding back production. Asian markets are also oversupplied, with traders continuing to put excess crude into floating storage, a key indicator for a glut.

- Market analyst have said that oil market is anticipated to be bullish for the second half of this year, based on supply and demand balances and the rebalancing is also going to start in the second half. But if Nigerian and Libyan production is picking up as well as they are now, then slowly things will be different.

- This week upstream benzene prices have decreased on weak demand sentiments from end users..

- FOB Korea and CFR China prices of Benzene were evaluated at USD 740/mt and USD760/mt respectively.

$1 = Rs. 64.24

Import Custom Ex. Rate USD/ INR: 65.35

Export Custom Ex. Rate USD/ INR: 63.70