N Hexane Weekly Report 21 April 2018

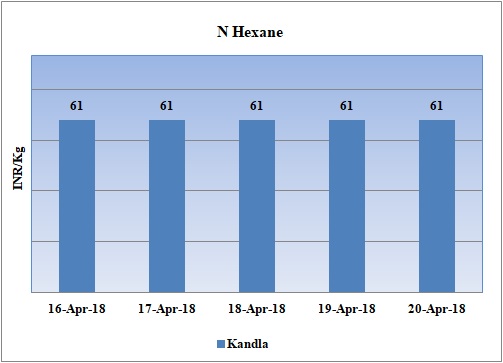

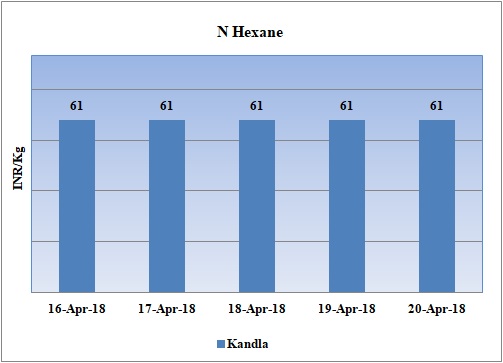

Weekly Price Trend: 16-04-2018 to 20-04-2018

- The above given graph focuses on the N Hexane price trend for the current week.

- Prices were assessed at the level of Rs.61/Kg in this week, with no change in compare to last week’s assessed values.

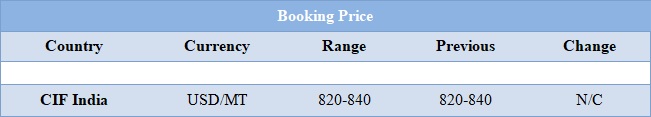

Booking Scenario

INDIA& INTERNATIONAL

- This week N hexane prices increase slightly in domestic market. Prices were assessed around Rs.61/Kg for bulk quantity.

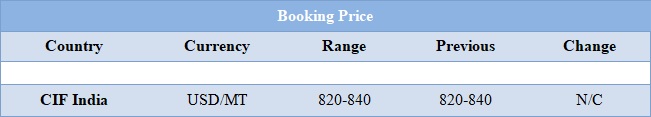

- CIF India values were assessed in the range of USD 820-840/MT, with no change for this week.

- PTT Global Chemical is planning to shut its cracker no1 for maintenance turnaround. The cracker will undergo maintenance in September 2018. The unit is likely to remain off-stream 40 days. The unit is based at Map Ta Phut in Thailand and has the production capacity of 460,000 mt/year and a propylene production capacity of 125,000 mt/year.

- The prices have seen a new height in crude sector since 2014 due to ongoing in global supply with Saudi Arabia intending for prices to still go high in the international market.

- The previous oversupply of crude is no more in the international market. Experts believe that reaching the marl of $ 70 is very near in the future.

- Oil prices have escalated through the week but on Thursday prices have remained mixed. On Thursday, closing crude values have decreased. WTI on NYME closed at $68.29/bbl; prices have decreased by $0.18/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.30/bbl in compared to last trading and was assessed around $73.78/bbl.

- The prices have seen a new height since 2014 due to ongoing in global supply with Saudi Arabia intending for prices to still go high in the international market.

- The previous oversupply of crude is no more in the international market. Experts believe that reaching the marl of $ 70 is very near in the future.

- Oil prices have escalated through the week but on Thursday prices have remained mixed. On Thursday, closing crude values have decreased. WTI on NYME closed at $68.29/bbl; prices have decreased by $0.18/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.30/bbl in compared to last trading and was assessed around $73.78/bbl.

$1 = Rs. 66.03

Import Custom Ex. Rate USD/INR: Rs. 66.70

Export Custom Ex. Rate USD/INR: Rs. 65.00