N-Butanol Weekly Report 18 June 2018

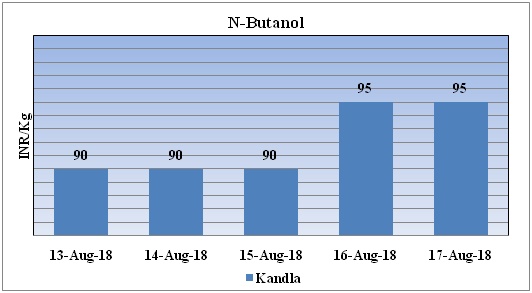

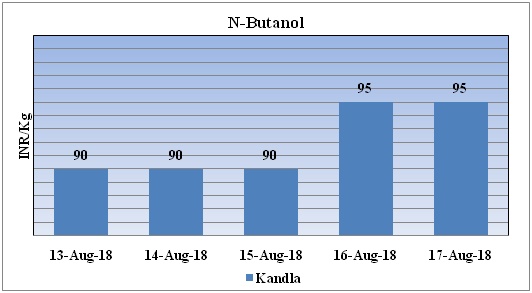

Weekly Price Trend: 13-08-2018 to 17-08-2018

- The above given graph focuses on the N-Butanol price trend for the current week.

- If we take a quick look at the above given weekly prices then it can be observed that the prices of N-Butanol have increased this week in compares to previous week and at the end of this week prices were assessed at the level of Rs. 95/Kg at Kandla port.

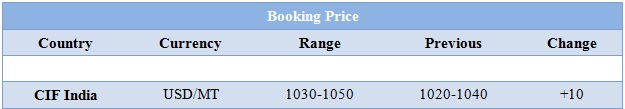

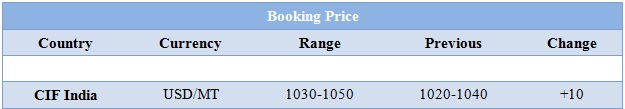

Booking Scenario

The prices of N-Butanol are also affected by duties that are there for different countries. For example, there is 7.5% duty on South Africa and the Europe Zone. And there is 2.5% duty on Malaysia. These prices are for full duty (7.5%) for US, Europe region.

INDIA & INTERNATIONAL

- This week domestic prices of N-Butanol have increased and were assessed at Rs.95/Kg for Kandla port.

- This week International N-Butanol prices also have increased.

- This week N-Butanol prices have increased with the increase in feedstock propylene prices and energy prices.

- US N-Butanol pricing continues to trend toward August rollovers.

- CFR China prices of propylene were evaluated at USD 1145/mt.

- FOB Korea prices of propylene were evaluated at USD 1095/mt.

- South East Asia prices of propylene were evaluated at USD 1030mt.

- This week crude oil prices have followed volatile trend. On Friday Crude prices edged higher, but were heading for yet another weekly decline on worries that oversupply would weigh on the U.S. market and that trade disputes and slowing global economic growth would slow demand for oil.

- On Friday, closing crude values have increased. WTI on NYME closed at $65.91/bbl. Prices have increased by $0.45/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.40/bbl in compare to last closing price and was assessed around $71.43/bbl.

- As per analysts, despite the bearish factors, prices were prevented from falling further because of U.S. sanctions against Iran, which target the financial sector from August and will include petroleum exports from November.

$1 = Rs. 70.15

Import Custom Ex. Rate USD/ INR: 71.10

Export Custom Ex. Rate USD/ INR: 69.40