N-Butanol Weekly Report 18 Feb 2017

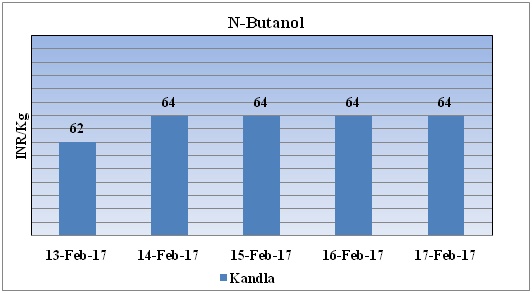

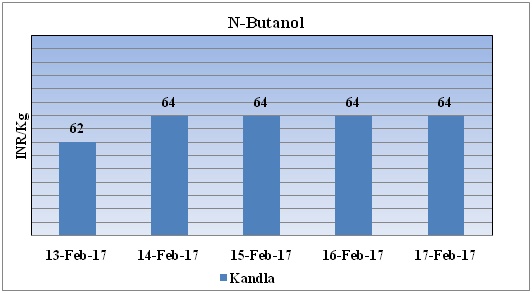

Weekly Price Trend: 13-02-2017 to 17-02-2017

- The above given graph focuses on the N-Butanol price trend for the current week.

- If we take a quick look at the above given weekly prices then it can be observed that the prices of N-Butanol have increasedthis week in compares to previous week and at the end of this week prices were assessed at the level of Rs. 64/Kg at Kandla port.

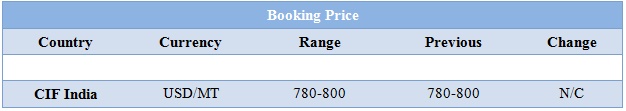

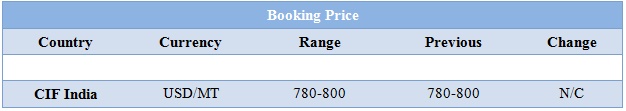

Booking Scenario

The prices of N-Butanol are also affected by duties that are there for different countries. For example, there is 7.5% duty on South Africa and the Europe Zone. And there is 2.5% duty on Malaysia. These prices are for full duty (7.5%) for US, Europe region.

INDIA & INTERNATIONAL

- This week domestic prices of N-Butanol have decreased and were assessed at Rs. 64/Kg for Kandla port.

- This week international market prices remained same by USD 790/mt.

- As per report, end user industry was looking for R&D for new product development on account of this demand has been growing in domestic market.

- Crude prices continue to oscillate in a shifting range as traders considered the conflicting influence of weakening of US dollar. There has been constant high supply in last few weeks along with rising levels in the US crude inventory levels.

- As per report U.S. commercial crude inventories rose, high fuel inventories and rising U.S. crude production meant oil markets would be over-supplied for some time, but that they would drain gradually, while the rest of the world already showing signs of tightness.

- The crude oil inventory build was really terrible for the market but the market does not seem to care because the products inventories were better than expected and are dragging crude oil prices up with it.

- Market Analysts said that in near term prices could be volatile as higher U.S. crude supplies balanced output cuts by the OPEC and other producing nations. Recently oil is in a very dangerous zone because market is moving with bearish velocity.

- On Thursday closing, there has been rise in crude values.WTI values increased by USD 0.25/bbl and was assessed around $53.36. On other side there was slight decline in Brent value was observed. Brent crude prices reduced by $0.10/bbl and were assessed around $55.65/bbl.

- CFR China prices of propylene were evaluated at USD 1025/mt.

- FOB Korea prices of propylene were evaluated at USD 1005/mt.

$1 = Rs. 67.00

Import Custom Ex. Rate USD/ INR: 67.85

Export Custom Ex. Rate USD/ INR: 66.15