N-Butanol Weekly Report 14 April 2018

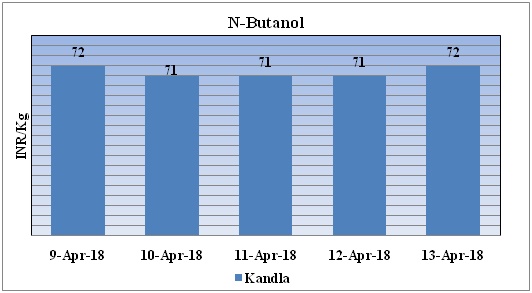

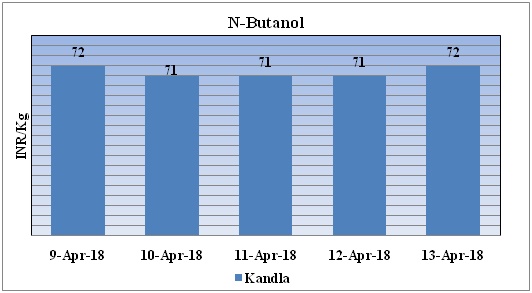

Weekly Price Trend: 09-04-2018 to 13-04-2018

- The above given graph focuses on the N-Butanol price trend for the current week.

- If we take a quick look at the above given weekly prices then it can be observed that the prices of N-Butanol have remained volatilethis week in compares to previous week and at the end of this week prices were assessed at the level of Rs. 72/Kg at Kandla port.

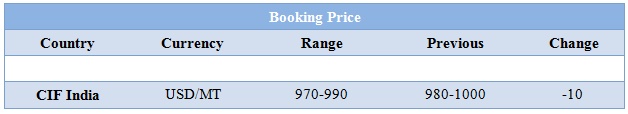

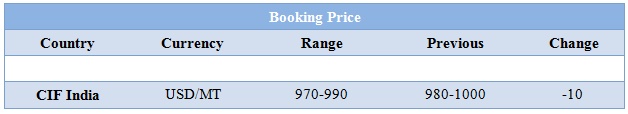

Booking Scenario

The prices of N-Butanol are also affected by duties that are there for different countries. For example, there is 7.5% duty on South Africa and the Europe Zone. And there is 2.5% duty on Malaysia. These prices are for full duty (7.5%) for US, Europe region.

INDIA & INTERNATIONAL

- This week domestic prices of N-Butanol have remained volatile and were assessed at Rs. 72/Kg for Kandla port.

- This week international market prices have plunged.

- This week N-Butanol prices have plunged on bearish demand.

- This week feedstock propylene prices have increased

- South East Asia prices of feedstock propylene were assessed at USD 925/mt.

- CFR China prices of propylene were evaluated at USD 1060/mt.

- FOB Korea prices of propylene were evaluated at USD 1025/mt.

- Oil prices have escalated through the week but on Thursday prices have remained mixed.

- On Thursday, closing crude values have mixed. WTI on NYME closed at $67.07/bbl; prices have increased by $0.25/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.40/bbl in compared to last trading and was assessed around $72.02/bbl.

- Oil markets remained tense on Thursday on concerns over a military escalation in Syria, although prices were some way off Wednesday's late-2014 highs as bulging U.S. supplies weighed. A trade dispute between the United States and China also kept markets on edge.

- Crude oil prices settled at three-year highs amid ongoing expectations that geopolitical tensions in the Middle East could add a possible ‘fear premium’ to oil, while continued OPEC cuts supported sentiment.

- If the U.S. does indeed launch missiles at Syria, this would heighten risk and likely at once push crude oil higher and depress equities further.

$1 = Rs. 65.20

Import Custom Ex. Rate USD/ INR: 65.90

Export Custom Ex. Rate USD/ INR: 64.20