Mixed Xylene Weekly Report 22 April 2017

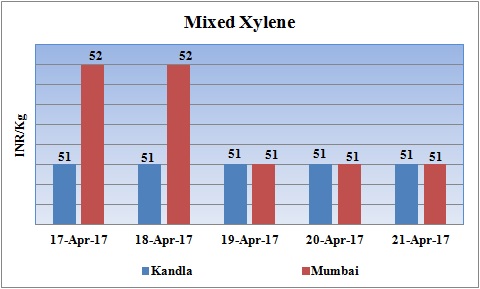

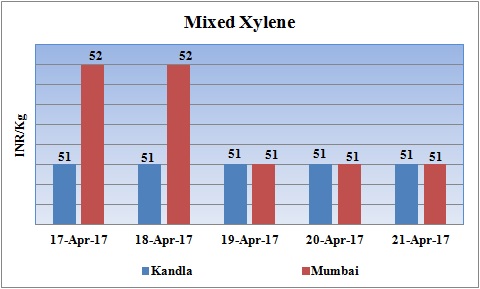

Weekly Price Trend: 17-04-2017 to 21-04-2017

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene remained soft-to-stable for this week. Prices were assessed at the level of Rs.51/Kg for Kandla port and for Mumbai port.

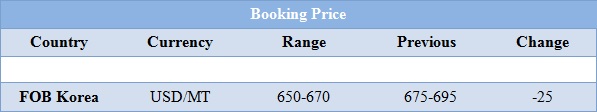

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.51/Kg at Kandla port and for Mumbai port.

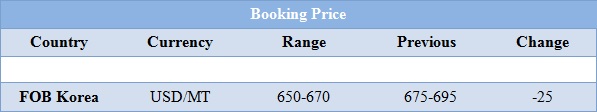

- International prices of Isomer grade Mixed Xylene reduced for this week. Prices were assessed in the range of USD 650-670/MTS with a decrease of USD 25/MTS in compare to last week’s closing values.

- CFR SE Asia prices were assessed in the range of USD 665-685/MT with an decrease of USD 20/MTS in compare to last week’s assessed values.

- There has been rise in values for Mixed Xylene and Toluene in China market on back of introduction of consumption tax on mixed aromatics. The consumption tax which is expected to be imposed on light cycle oil and all will curb the inflow of the products. The mixed aromatic are exclusively used as a gasoline blendstock, it is expected to increase the demand for alternative blendstocks such as toluene, MX and, possibly MTBE, if mixed aromatics imports become uneconomical.

- India’s leading petrochemical company RIL will make its first consignment of Para Xylene exported to China from its second phase of its plant at Jamnagar. The new unit has the production capacity of 2.2 mln mt/year. Of the 35,000 mt of PX due to load from Sikka in Gujarat on the MT Bunga Angelica, 15,000 mt will be discharged at Dalian in China under term contracts. The rest will form part of Reliance's regular shipments to the region.

- This week oil prices followed mixed trend. On Wednesday oil slumped after U.S. data showed a smaller-than-expected drop in overall crude stocks and a surprising build in gasoline inventories, which raised worries about excessively high global supply.

- According to reports, the surprise builds in gasoline, along with an increase in U.S. production and imports from OPEC nations, pressured prices. With just weeks to go before OPEC and other producers have to sign off on a new deal to hold down production. OPEC technical staff this month is expected to make a recommendation on whether to extend the cuts, and OPEC's monitoring committee meets the day before OPEC's May 25 meeting.

- Market players have said that to prevent a further ballooning in supplies, some OPEC producers including Saudi Arabia and Kuwait are lobbying to extend the pledge to cut production beyond June.

- On Thursday, closing crude values have remained mixed.WTI on NYME closed at $50.27/bbl, prices have decreased by $0.17/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.06/bbl in compared to last trading and was assessed around $52.99/bbl.

$1 = Rs. 64.61

Import Custom Ex. Rate USD/ INR: 65.55

Export Custom Ex. Rate USD/ INR: 63.85