Mixed Xylene Weekly Report 20 May 2017

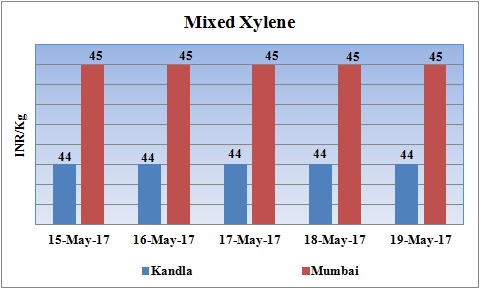

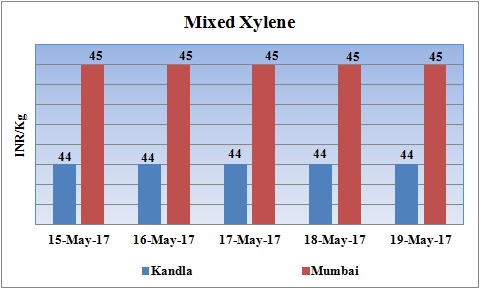

Weekly Price Trend: 15-05-2017 to 19-05-2017

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene remained soft for this week. Prices remained stable for this week. Prices were assessed at the level of Rs.44/Kg for Kandla port and Rs.45/Kg for Mumbai port.

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.44/Kg at Kandla port andRs.44/Kg for Mumbai port.

- International prices of Isomer grade Mixed Xylene declined significantly for this week. Prices were assessed in the range of USD 625-645/MTS, reduced by USD 5/MTS in compare to last week’s closing values.

- CFR SE Asia prices were assessed in the range of USD 655-675/MT, increased by USD 10/MTS in compare to last week’s assessed values.

- PTT Global Chemical is planning to shut its no2 para xylene plant for maintenance turnaround. The plant is likely to go off-stream in the mid of June. It is likely to remain off-stream for around 4 weeks. Unit is based at Rayong province in Thailand and has the manufacturing capacity of 765000 mt/year.

- The final agreement has been drafted between Jurong Aromatics and Exxon Mobil. The company will be acquire its Jurong based unit. This aromatic complex includes a 100,000 b/d condensate splitter, also has the capacity to produce 783,000 mt/year of jet fuel, 647,000 mt/year of light naphtha, 662,000 mt/year of gasoil, 283,000 mt/year of LPG, 35,000 mt/year of fuel oil, 46,000 mt/year of hydrogen and 18,000 mt/year of heavy aromatics, as well as petrochemical products including 800,000 mt/year of paraxylene, 400,000 mt/year of benzene and 200,000 mt/year of orthoxylene. Acquisition of the Jurong aromatics plant will increase ExxonMobil's Singapore aromatics production to over 3.5 million mt/year, of which 1.8 million mt is PX.

- This week overall crude oil prices plunged with little instability. Recent announcements by Russia and Saudi Arabia have helped oil prices to recover and several analysts have highlighted the energy sector as a potential play for investors.

- According to recent reports, Russia and Saudi Arabia has announced about the cut in supply of oil to be extended for another nine months i.e till March 2018 and are likely to discuss this matter in their next meeting.

- Experts from tm the oil market believe that Russia and other major producers could help drive oil prices back to $60 per barrel or more with a new production deal, but again that would be a green signal for U.S. shale drillers. This drive even could bring the oil to range in $60 oil the end of the year, but the gains are not expected to spike much higher.

- On Thursday, closing crude values have increased.WTI on NYME closed at $49.35/bbl, prices have increased by $0.28/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.30/bbl in compared to last trading and was assessed around $52.51/bbl.

$1 = Rs. 64.64

Import Custom Ex. Rate USD/ INR: 65.30

Export Custom Ex. Rate USD/ INR: 63.60