Mixed Xylene Weekly Report 18 March 2017

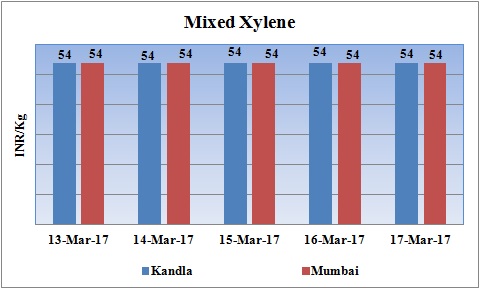

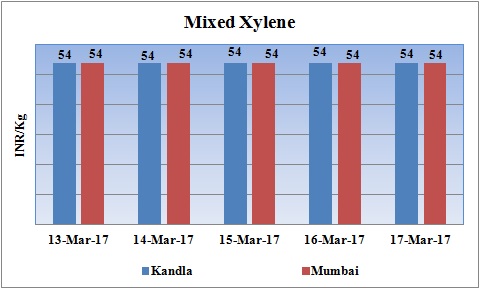

Weekly Price Trend: 13-03-2017 to 17-03-2017

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene remained stable for this week. Prices were assessed at the level of Rs.54/Kg for Kandla port and for Mumbai port.

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.54/Kg at Kandla port and for Mumbai port.

- International prices of Isomer grade Mixed Xylene remained unchanged for this week. Prices were assessed in the range of USD 660-680/MTS with no change in compare to last week’s closing values.

- CFR SE Asia prices were assessed in the range of USD 680-700/MT with no change in compare to last week’s assessed values.

- Leading petrochemical manufacturer of petrochemicals Idemitsu Kosan and JX Nippon Oil Energy has re-nominated their Asian Contract Prices for the month of March.

- Idemitsu Kosan lowered its price for Para Xylene by USD 40/MTS and new price has been USD 940/MTS. X Nippon Oil & Energy nominated its March ACP at $980/mt CFR, while South Korea's SK Global Chemical and S-Oil nominated at $970/mt and $960/mt CFR respectively.

ExxonMobil was the last producer to nominate its March Para Xylene Asia CP, at $970/mt CFR Monday. Although the nominations are higher than the February settlement which was around USD 900/MT.

- This week oil prices remained mixed with heavy fluctuation throughout the week. On Thursday oil prices plunged after a heavy leap as rising output from the U.S. remained a threat to efforts by other major producers to rebalance the market. Oil prices continued to find some support, while on wednesday prices declined due to heavy supply along with weakening of dollar on back of the Federal Reserve’s less-hawkish-than-expected rate announcement.

- According to reports, Global oil inventories rose for the first time in six months in January, despite the OPEC agreement. Iraq is planning to boost output later in the year even as the OPEC member reaffirmed its commitment to the group’s decision to cut production to counter a global glut.

- Some market players believe that in near term crude oil prices are likely to trade positive on the back of surprise drawdown in U.S. crude inventories.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $48.75/bbl, prices have decreased by $0.11/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.07/bbl in compared to last trading and was assessed around $51.74/bbl.

- The strong mandate of state elections last week will have a significant impact on economic reforms in the country and will boost it to higher level. This in turn has led to strengthening of Indian currency against dollar and has improved to its highest level in last two years. This will certainly have positive effect on petchem sector as majority of the petrochemical is being imported in the country.

$1 = Rs. 65.46

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50