Methanol Weekly Report 8 March 2019

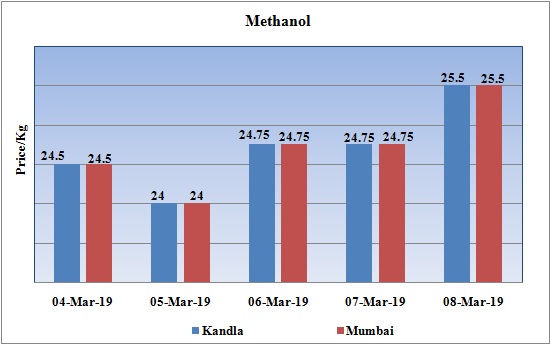

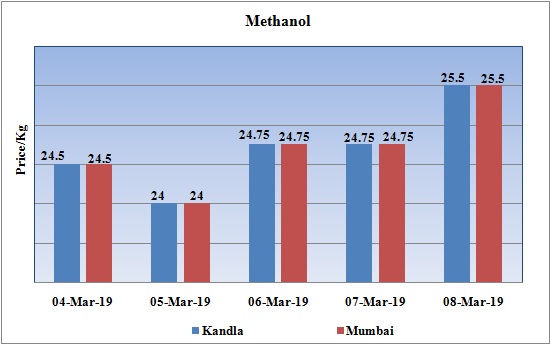

Weekly Price Trend: 04-03-2019 to 08-03-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week. There has slowdown in domestic prices and weakening of values continued throughout this week.

- By the end of the week prices were assessed around Rs 25.5/Kg for Kandla and Mumbai ports.

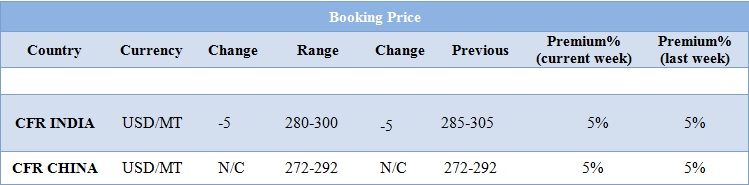

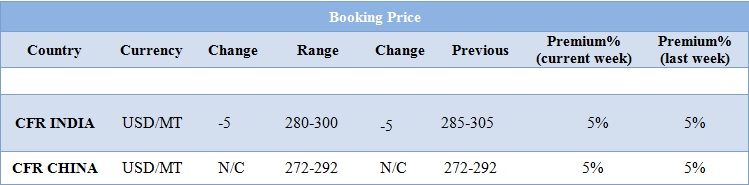

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained highly weak and feeble. Prices in the domestic market reduced to the level of Rs.24.5/Kg for this week.

- CFR India prices were assessed around USD 290/MTS, reduced by USD 5/MT for this week. On other side CFR China prices remained unchanged with no change in values. Methanol prices have been highly unpredictable and since last few weeks. With heavy inventory levels on Indian port, prices were predicted to show a downward trend.

- There has been step sluggishness in the domestic prices for Methanol in the Indian domestic market. The restart of many units back in Middle East which are the suppliers for Methanol has put an additional pressure on pricing. The average pricing of Methanol for Kandla port and Mumbai in the month February has been around Rs.24.5/Kg.

- Buyers are believed to reduce their imports and will operate as per demand only till the end of the financial year next month.

- Restart of units in Iran, Indonesia has set the platter of material for India but the Indian buyers are making purchase very cautiously.

- U.S. West Texas Intermediate (WTI) crude oil futures were at $56.32 per barrel, down 34 cents, or 0.6 percent, from their last settlement.

- Brent crude oil futures were at $65.83 per barrel at 0358 GMT, down 47 cents, or 0.7 percent from their last close.

- Financial markets, including crude oil futures, took a hit after ECB President Mario Draghi said on Thursday the economy was in "a period of continued weakness and pervasive uncertainty".

- China's February dollar-denominated exports fell 21 percent from a year earlier, coming in far worse than analysts' expectations, while imports dropped 5.2 percent, official data showed on Friday.

- Russia has bagged to become the major exporter of crude to US after Venezuela sanctions. U.S. crude oil imports from Venezuela slumped to just 83,000 bpd in the week to March 1, compared to 208,000 bpd in the previous week.

- The U.S. sanctions on Venezuela have also prohibited U.S. exports of naphtha to the Latin American country which uses the product to dilute its heavy crude. SO here again Russia has came to rescue for these nations. Rosneft has carried out shipments of heavy naphtha to Venezuela expected in the next few weeks

PLANT NEWS

Methanol plant shut down by Brunei Methanol Corporation

- Brunei Methanol Corporation (BMC) has shut down its Methanol unit for maintenance turnaround. The unit was shut down on 26th February 2019 for annual maintenance. Unit is likely to resume its production back on 21st April 2019.

Methanol plant to be shutdown by Fanavaran Petrochemical

- Fanavaran Petrochemical has announced its maintenance schedule for its Methanol unit. It is likely to undergo maintenance next week and is expected to remain off-stream for around two weeks. Unit is based at Bandar Iman, in Iran and has the production capacity of 1,000 mt/year.

Methanol plant shut down by Qatar Fuel Additives (QFAC)

- QFAC will restart its Methanol unit after brief maintenance. The unit has been shut down on 22 February and is likely to remain off-stream for around 5-6 weeks. The restart is date likely to be around 7thapril.

- Unit is based at Mesaieed in Qatar and has the production capacity of 1,100 mt/year.

$1 = Rs. 69.91

Import Custom Ex. Rate USD/ INR: 71.00

Export Custom Ex. Rate USD/ INR: 69.30