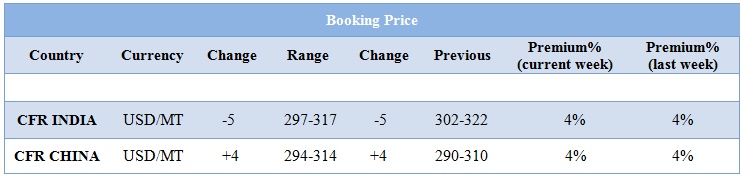

Methanol Weekly Report 8 April 2017

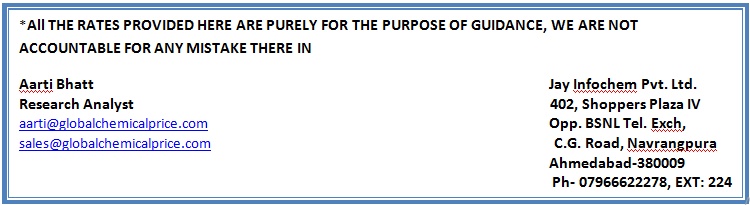

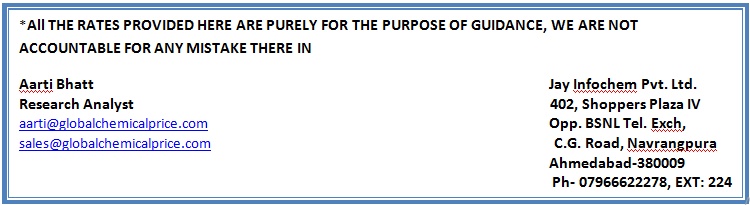

Weekly Price Trend: 03-04-2017 to 07-04-2017

- The above graph focuses on the Methanol price trend for the current week. Prices have followed up inclination for this week. By the end of the week prices were assessed around Rs.24.5/Kg for Kandla and Rs 24/kg Mumbai ports.

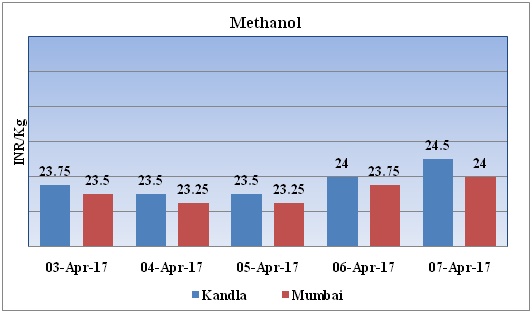

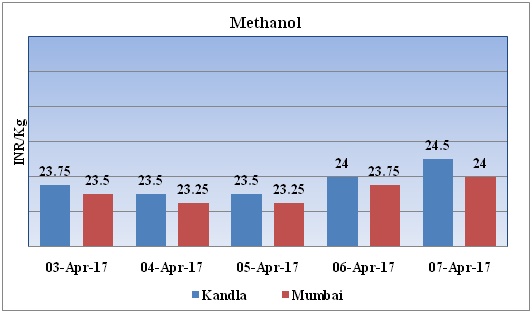

Total import for last six months

Above graph represents the total import quantity of Methanol in previous six months. As per chart In total imports were around 890659mt.In last six months in the month of November, 2016 higher quantity has been imported while in January import were lesser.

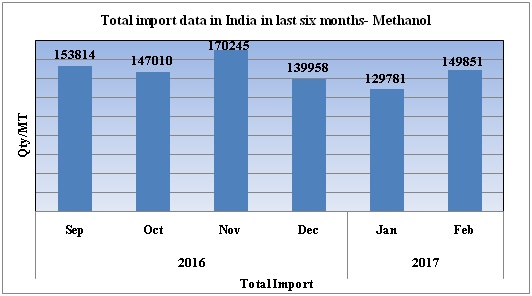

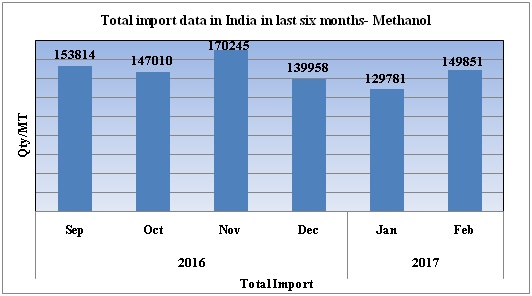

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed up inclination and by the end of the week prices were evaluated at Rs 24.5/kg for Kandla and Rs 24/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 297-317/MTS. Prices have plunged USD 5/mt in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 327/mt.

- CFR China prices were assessed in the range of USD 294-314/MT prices have increased in compares to previous week.

- This week methanol market have revealed positive move with the improved buying sentiments.

- In China methanol prices have increased while prices decline in Asia.

- China’s MTO units begin shutdowns on margin despair. Zhejiang Xingxing New Energy plans to bring its 690,000 tonne/year MTO unit off line in April.

- This week mostly oil prices have followed up inclination. On Tuesday prices have declined tiny but again through the week prices have escalated. Oil prices have increased as bullish sentiment remained supportive. Oil prices have increased but market players remained vigilant about record-high U.S. crude inventories.

- On Friday U.S. crude futures jumped more than in Asia after President Trump ordered the first direct American military action against the regime of Syrian President Bashar al-Assad.

- Presently traders have been watching U.S. gasoline inventories as an indicator of what may happen with crude supplies.

- As per market analyst the dollar has come under some pressure of late and this pushes up oil as well as the U.S. dollar value of offshore earnings. Traders say oil is likely to remain in its recent wide range. OPEC Secretary said that that the oil market is already rebalancing and global oil inventories are starting to come down after three months of output cuts by OPEC and their 11-non-OPEC partners. While rising U.S. crude production has some OPEC members calling for an extension of the cuts through December.

- On Thursday, closing crude values have increased.WTI on NYME closed at $51.70/bbl, prices have increased by $0.55/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.53/bbl in compared to last trading and was assessed around $54.89/bbl.

$1 = Rs. 64.28

Import Custom Ex. Rate USD/ INR: 65.90

Export Custom Ex. Rate USD/ INR: 64.20