Methanol Weekly Report 7 June 2019

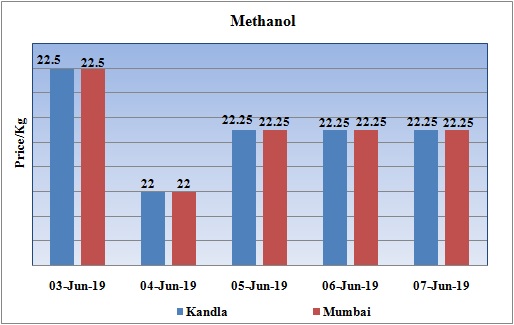

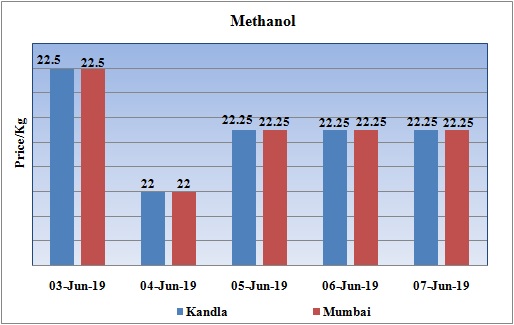

Weekly Price Trend: 03-06-2019 to 07-06-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.22.5/Kg for bulk quantity by end of the week. Prices were reduced by Rs.0.5/Kg for this week from last week’s closing values.

- By the end of the week prices were assessed around Rs 22.25/Kg for Kandla and Mumbai ports.

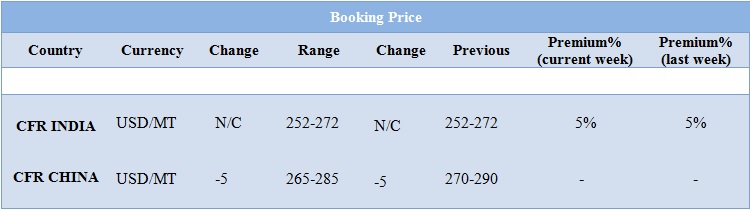

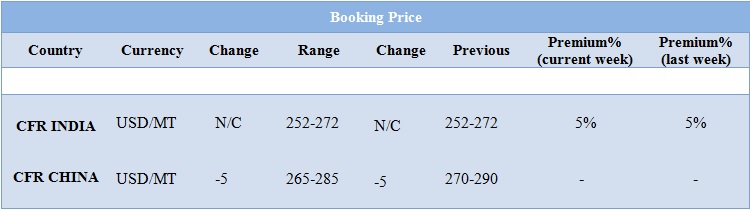

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable there was a constant variation in the values. Prices in the domestic market improved and were assessed at the level of Rs.22.25/Kg for this week.

- CFR India prices were assessed around USD 262/MTS, remained unchanged for this week.

- There has been continuous decline in international prices for Methanol on back of abundant supply and bulk availability of stocks at the port.

- This week there has been decline in domestic values due to continuous variation in crude values in international market. Major traders are unable to anticipate the prices and are not in position to take any firm decision for any fresh purchase.

- The extensive summer in the country has been affecting a lot to the western and northern part of the country. Hard heat wave has derailed the work at many ports including Kandla where temperature is soaring to the level of 48-49 degrees.

- Crude prices has seen significant rise in prices in this week, a rise highest in last five months. This rise has been well supported by a report that Washington could postpone trade tariffs on Mexico and signs OPEC and other producers may extend crude supply cuts.

- On Wednesday, Brent and WTI sank to their lowest levels since mid-January at $59.45 and $50.60 respectively, after US crude production hit a new record-high and stockpiles climbed to their highest since July 2017. But on Thursday oil prices followed US stocks higher after reports confirmed that the United States is considering a delay in the tariffs on Mexico as talks continue.

- Prices had been supported by supply curbs by the Organization of the Petroleum Exporting Countries (OPEC) and some allies including Russia. Supply has also been limited by US sanctions on oil exports from Iran and Venezuela.

- On Thursday day, closing crude values have increased. WTI on NYME closed at $52.69/bbl. Prices have increased by 0.91/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $1.04/bbl in compare to last closing price and was assessed around $61.67/bbl.

- Methanol plant no2 restarted by Zargos Petrochemical. The unit was restarted yesterday and has been currently operating at 80% of its capacity. Earlier the unit was shut down in

- May end due to some technical glitch. It is based at Assalyueh in Iran and has the production capacity of 1.65mn t/yr of methanol. The unit no1 with same capacity is operating at 90% of its capacity.

$1 = Rs. 69.47

Import Custom Ex. Rate USD/ INR: 70.30

Export Custom Ex. Rate USD/ INR: 68.60