Methanol Weekly Report 7 Dec 2018

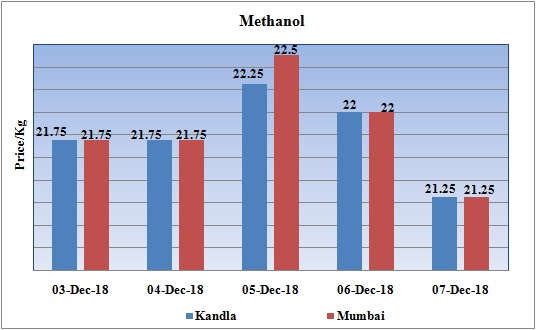

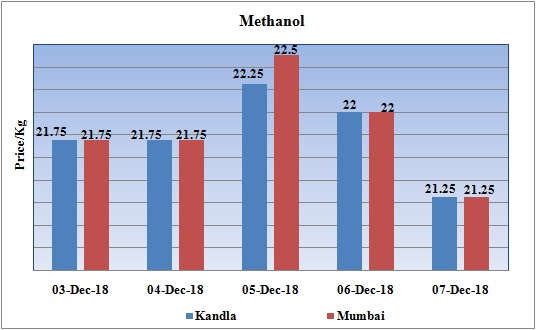

Weekly Price Trend: 03-12-2018 to 07-12-2018

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week.

- By the end of the week prices were assessed around Rs 21.25/Kg for Kandla and Mumbai ports.

- Domestic prices have reduced by Rs.0.75/Kg for bulk quantity in the span of one week. Decline has been due to oversupply of chemical in the domestic market.

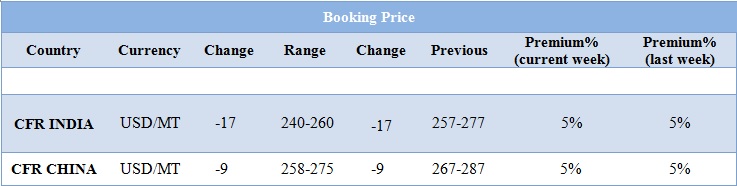

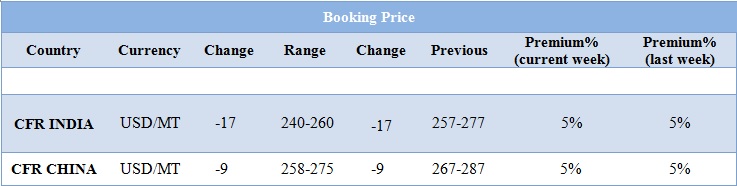

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol prices declined significantly on back of oversupply of chemical in the international market. By end of the week prices were assessed around Rs.21.25/Kg for Kandla and Mumbai port for bulk quantity.

- CFR India prices were assessed around USD 250/MTS, reduced by USD 17/MT for this week. On other side CFR China prices were assessed around USD 268/MT reduced by USD 9/MT for this week.

- Crude market has remained vulnerable throughout this week. There has been significant decline in olefins prices and aromatic products in this week. The constant decline in crude values has plummeted the immediate prices for Benzene and Toluene and Styrene. Crude oil prices fell steeply this year from 4 October, helping to push naphtha costs lower and putting pressure on prices downstream.

- Market is looking forward for China and US trade war. Oil prices fell on Friday as Opec discussed a potential exemption from cutting output for Iran and as the producer club sought to get heavyweight supplier Russia on board. International Brent crude oil futures fell below $60 per barrel, trading at $59.53 per barrel at 0750 GMT, down 53 cents, or 0.9 per cent from their last close.

- On other side India has signed an agreement with Iran to pay for crude oil t imports from the Persian Gulf nation in rupees, Under US sanctions, India can export foodgrains, medicines and medical devices to Iran. India had won the exemption after it agreed to cut imports maximum of 300,000 barrels a day of crude oil. This compares to an average daily import of about 560,000 barrels this year.

- Major manufacturer Methanex has also cut down its rate for Asian and North America market.

- Asian contract prices has been reduced by USD 80/MT and were posted at USD 430/MT. Prices posted for the region of North America are USD 469/MT reduced by USD 50/MT for this month.

$1 = Rs. 70.77

Import Custom Ex. Rate USD/ INR: 71.75

Export Custom Ex. Rate USD/ INR: 70.05