Methanol Weekly Report 6 September 2019

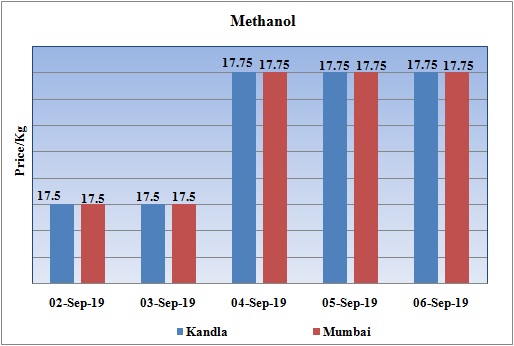

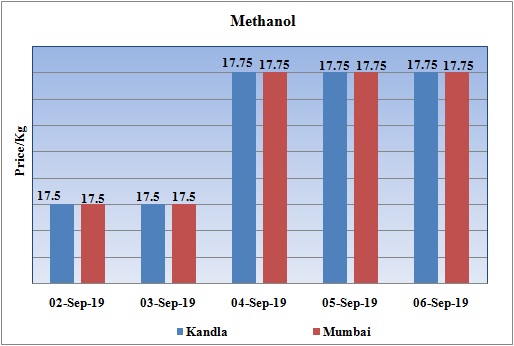

Weekly Price Trend: 02-09-2019 to 06-09-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.17.75/Kg for bulk quantity by end of the week.

- By the end of the week prices were assessed around Rs 17.75/Kg for Kandla and Mumbai ports.

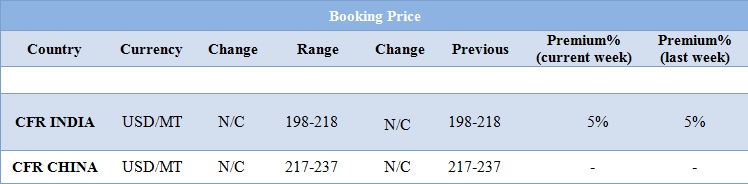

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable there was a constant variation in the values. Prices in the domestic market reduced significantly for this week and were assessed at the level of Rs.17.75/Kg for bulk quantity.

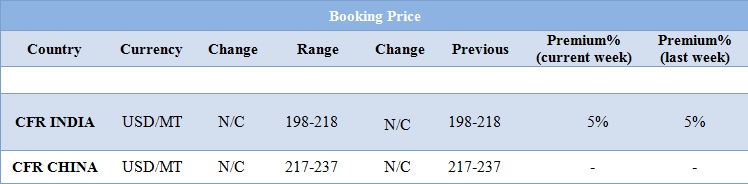

- CFR India prices were assessed around USD 208/MTS, remained unchanged for this week. With ongoing monsoon season at its peak there has been significant decline in demand for Methanol. There has been slowdown in demand from domestic market due to monsoon across the nation.

- Indian market is operating at slow note due to ongoing festive season across the nation.

- CFR China prices were assessed around USD 217-237/MT, with no change in values in compare to last week’s closing values for this week.

- Benzene the major source for aromatic products has also improved for this week. FOB Korea values for Benzene were assessed around USD 687/MT, increased by USD 7/MT for this week, while CFR China prices also improved and were assessed at the level of USD 687/MT for this week.

- On Thursday, closing crude values have increased. WTI on NYME closed at $56.30/bbl. Prices have increased by 0.04/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 0.25/bbl in compare to last closing price and was assessed around $60.95/bbl.

- Salalah Methanol Co (SMC) has shut down its Methanol unit for maintenance turnaround. The unit was shut down in the last week of August and is likely to remain off-stream for around 3-4 weeks. Unit is likely to restart by third week of September 2019. Unit is based at Salalah in Oman and has the production capacity of 1.3 mln mt/year.

$1 = Rs. 71.72

Import Custom Ex. Rate USD/ INR: 71.85

Export Custom Ex. Rate USD/ INR: 70.15