Methanol Weekly Report 5 July 2019

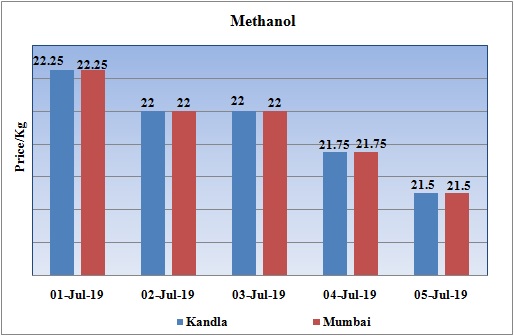

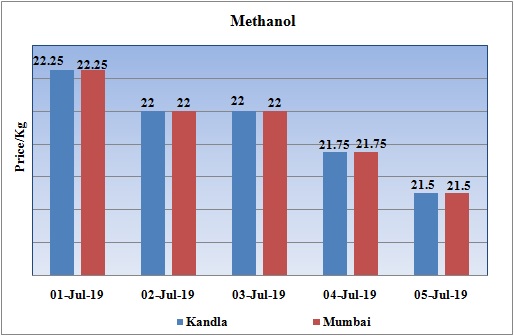

Weekly Price Trend: 01-07-2019 to 05-07-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.21.5/Kg for bulk quantity by end of the week. Prices reduced significantly by Rs.1.50/Kg for this week.

- By the end of the week prices were assessed around Rs 21.5/Kg for Kandla and Mumbai ports.

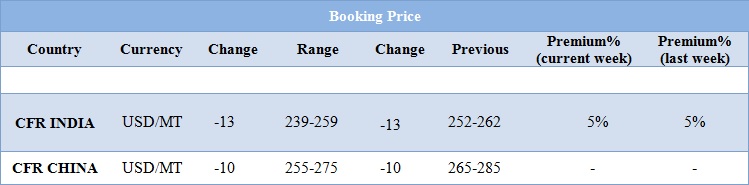

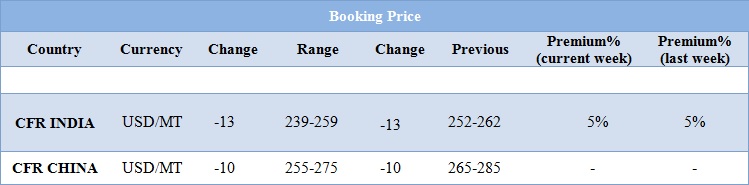

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable there was a constant variation in the values. Prices in the domestic market reduced significantly for this week and were assessed at the level of Rs.21.5/Kg for bulk quantity.

- CFR India prices were assessed around USD 249/MTS, reduced by USD 13/MT for this week. With ongoing monsoon season at its peak there has been significant decline in demand for Methanol. There has been slowdown in demand from domestic market due to monsoon across the nation.

- Market will react more aggressively in India as today first budget has been declared by the new government. The implication of budget on petrochemical segment will be visible on Monday.

- Crude oil prices fell on Friday on weak economic indicators from the United States and Germany, shrugging off tensions around Iran and this week's decision by OPEC and its allies to extend a supply cut deal until next year.

- Oil prices eased lower on Friday morning as concerns over global economic growth offset escalating geopolitical tensions in the Middle East

- Weak industrial demand gave a bearish signal for oil demand. Global growth remains the main factor holding back crude prices," said Alfonso Esparza, senior analyst at OANDA. The OPEC+ deal will keep prices from falling too hard, but there must be an end to trade protectionism to assure the demand for energy products recovers.

- On Thursday day, closing crude values have remained same. WTI on NYME closed at $57.34/bbl. Prices have remained same in compared to last closing prices. While Brent on Inter Continental Exchange have remained same in compare to last closing price and was assessed around $63.82/bbl.

CFR CHINA

- With start up of new Methanol-to-Olefins unit in China the demand for Methanol is likely to gain a significant boost in next few weeks. The MTO unit – with designed capacities of 240,000 tonnes/year for ethylene and 360,000 tonnes/year for propylene - started trial runs on last week.

- Further Luxi Chemical and Zhong’an Lianhe Chemical were also expected to start conducting trial runs at their plants in July. Luxi Chemical’s 290,000 tonne/year MTO unit in Shandong province has its own methanol units. Once the MTO unit start-up, the company will stop selling methanol and sell olefins instead.

- Zhong’an Lianhe Chemical’s 600,000 tonne/year coal-to-olefin (CTO) unit in Anhui province has its own downstream polypropylene (PP) and polyethylene (PE) units. Further more such units are likely to get start up by October-November of this month.

$1 = Rs. 68.42

Import Custom Ex. Rate USD/ INR: 69.75

Export Custom Ex. Rate USD/ INR: 68.05