Methanol Weekly Report 4 October 2019

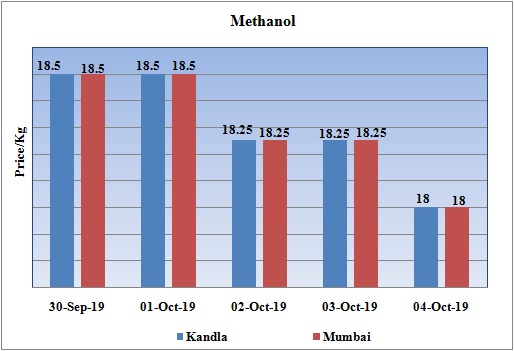

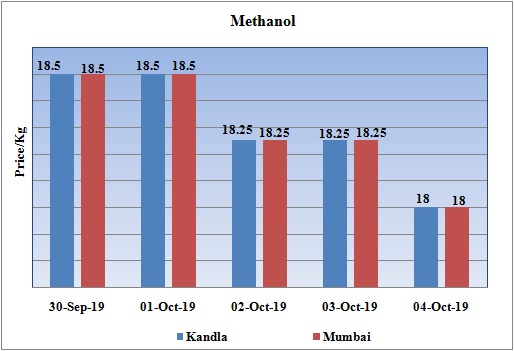

Weekly Price Trend: 30-09-2019 to 04-10--2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.18/Kg for bulk quantity by end of the week.

- By the end of the week prices were assessed around Rs 18/Kg for Kandla and Mumbai ports.

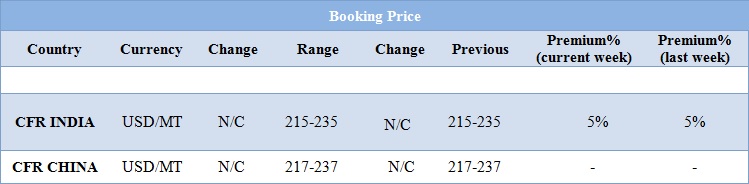

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable there was a constant variation in the values. Prices in the domestic market reduced slightly for this week and were assessed at the level of Rs.18/Kg for bulk quantity.

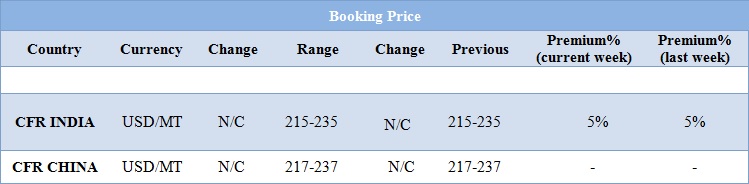

- CFR India prices were assessed around USD 225/MTS, remained unchanged for this week.

- CFR China prices were assessed around USD 217-237/MT, with no change in values in compare to last week’s closing values for this week.

- China is celebrating its Golden week festival next week. So most of Chinese markets are not available and will resume work from next week.

- There have been significant changes across the global market affecting the demand for petrochemicals.

- Global auto market has been at its lowest phase affecting the chemical sector associated with automobile sector.

- Global economic factor i.e. slowdown in economies, liquidity crunch and the political differences between China and US has been hampering the global trade and has been making it more polarized. The US$ has been rising due to increased uncertainty, creating currency risk for those who have borrowed in dollars; geopolitical risks are becoming more obvious.

- Chemical industry capacity utilization, the best leading indicator for the global economy, has been in decline since December 2017, leading to conclusion of recession in near future and the bankruptcies among over-leveraged firms will inevitably increase.

- On Thursday, closing crude values have mixed. WTI on NYME closed at $52.45/bbl. Prices have decreased by 0.19/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 0.02/bbl in compare to last closing price and was assessed around $57.71/bbl.

MTO unit restarted by Shenhua Coal Co

- Shenhua Coal to Liquid and Chemical Co has restarted its Methanol-to-Olefins unit after brief maintenance. Earlier the unit was shutdown in the month of July for an annual maintenance. The unit has restarted its production in last week. Unit is based at Yulin in Shaanxi in China and has the production capacity of ethylene around 300,000 mt/year and propylene capacity of 300,000 mt/year.

MTO unit restarted by Shandong Yangmei Hengtong Chemical

- Shandong Yangmei Hengtong Chemical has restarted its Methanol-to-Olefins unit after brief maintenance period. Earlier the unit was shutdown in the month of July for an annual maintenance schedule. Unit has resumed its production in last month.

- Unit is based at Shandong province of China and has the production capacity of ethylene production capacity of 120,000 mt/year and propylene capacity of 180,000 mt/year.

$1 = Rs. 70.96

Import Custom Ex. Rate USD/ INR: 72.15

Export Custom Ex. Rate USD/ INR: 70.45