Methanol Weekly Report 4 Jan 2019

Weekly Price Trend: 31-12-2018 to 04-01-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week. There has been continuous decline in domestic prices due to supply glut in international market.

- By the end of the week prices were assessed around Rs 19.5/Kg for Kandla and Mumbai ports.

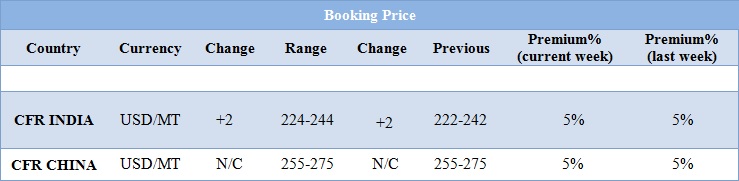

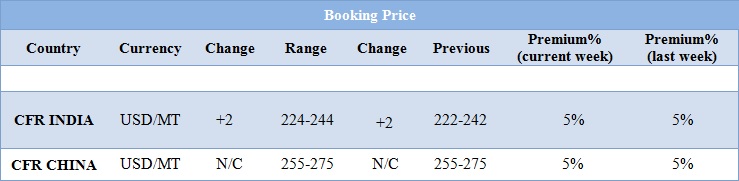

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol prices improved with correction demand.

- In last few weeks there has been abundant supply in domestic market leading to heavy decline in domestic values.

- Prices in the domestic market floated in the range of Rs.20/Kg for bulk quantity.

- CFR India prices were assessed around USD 234/MTS, slightly increased by USD 2/MT for this week. On other sideCFR China prices remained stable with no change in values in this first week of 2019.

- Oversupply of the chemical coupled with lousy demand has demoralized the market sentiments for methanol market. Experts say they its really difficult to make any assumption for the pricing of methanol even for next week.

- Canada based Methanex has posted its North American and Asian contract prices for the month of January 2019.

- Asian contract prices has been reduced by USD 60/MT and were posted at USD 370/MT. There has been significant decline Methanol price on back of abundant supply in the Asian region with limited demand.

- There has been significant lowering in crude prices in last few weeks. With end of week last week Brent and WTI witnessed hike in its values on back of improvement in US and CHINA trade talks.

- Oil prices increased by more than 1 percent on Monday with an optimistic view of discussion between USD and Chinese delegations. This could lead to supply cuts by major producers to support the market.

- Brent crude futures were at $57.75 per barrel at 0404 GMT, up 69 cents, or 1.2 percent, from their last close.

- U.S. West Texas Intermediate (WTI) crude oil futures were at $48.67 per barrel, up 71 cents, or 1.5 percent.

PLANT NEWS

Methanol unit no2 unit restarted by China's Tangshan Zhongrun

- Tangshan Zhongrun Coal Chemical restarted its Methanol unit no2 after brief maintenance. Earlier the nit was shut down in the last week of October last year on back of environmental issues.

- The unit has been restarted last week with full capacity. Unit is based at Tangshan in Hebei province of China and has the production capacity of 100,000 tonnes/year.

Methanol plant shut down by Inner Mongolia Boyuan

- Methanol plant has been shut donw by Inner Mongolia Boyuan on backnof shortage in he supply of natural gas. The unit is based at Erdos in inner Mongolia and has the manufacturing capacity of 400,000 of Line 1 and 600,000 of Line 2.

$1 = Rs. 69.87

Import Custom Ex. Rate USD/ INR: 71.25

Export Custom Ex. Rate USD/ INR: 69.55