Methanol Weekly Report 31 March 2018

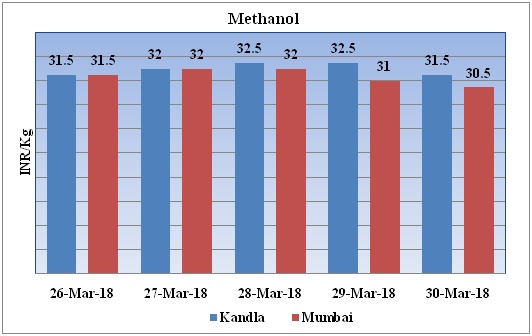

Weekly Price Trend: 26-03-2018 to 30-03-2018

The above graph focuses on the Methanol price trend for the current week. Prices have followed volatile trend for this week. By the end of the week prices were assessed around Rs 31.5/Kg for Kandla and Rs 30.5/kg Mumbai ports.

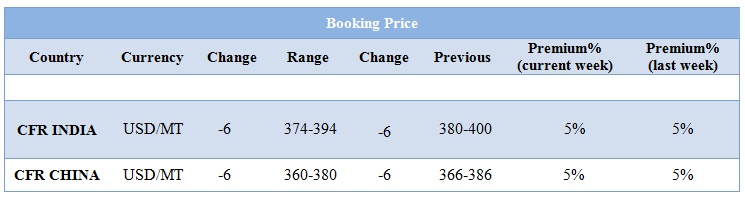

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed volatile trend and by the end of the week prices were evaluated at Rs 31.5/kg for Kandla and Rs 30.5/kg for Mumbai ports.

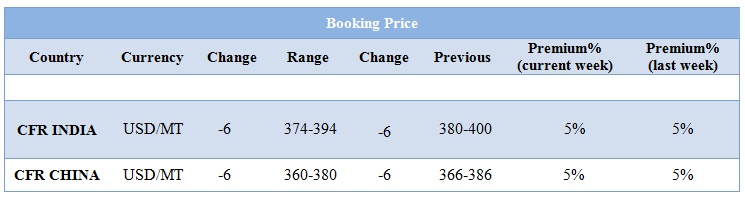

- CFR India prices were assessed in the range of USD 384/MTS. Prices have decreased by USD 6/mt in compares to previous week.

- CFR China prices of methanol were evaluated at USD 370/mt.

- FOB Korea prices of Methanol were evaluated USD 408/mt.

- This week South China methanol prices increase as Nansha port closes.

- Presently methanol market is moving with uncertain velocity in domestic market on account of this some market players have adopted observing stances.

- US April methanol contract prices remained firm.

- Canada based Methanex posted its prices for the month of April yesterday. The prices posted for Asia Pacific region remain unchanged and were around USD 460/MT. The prices posted for North America region were around USD 496/MT. Prices posted for the region of Europe around Euro 380/MT, remained unchanged for this month.

- This week methanol prices have fluctuated in domestic market on volatile demand sentiments, said by market players.

- This week crude oil prices have followed weak trend but on Thursday oil prices have escalated by 1 percent as the equities markets rallied and as market participants weighed a rise in U.S. crude inventories and production against continued OPEC supply curbs.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $64.94/bbl; prices have increased by $0.56/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.74/bbl in compared to last trading and was assessed around $70.27/bbl.

- Market players said that strong compliance on supply cuts from members of The OPEC and allies like Russia have supported prices. OPEC sources said the group and its allies are likely to keep their deal on cutting output for the rest of 2018 when they meet in June.

- As per market report, China was taking its first steps to pay for imported crude oil in yuan instead of the U.S. dollar. This week marked the launch of the Shanghai crude oil futures

$1 = Rs. 65.17

Import Custom Ex. Rate USD/ INR: 65.80

Export Custom Ex. Rate USD/ INR: 64.15