Methanol Weekly Report 31 March 2017

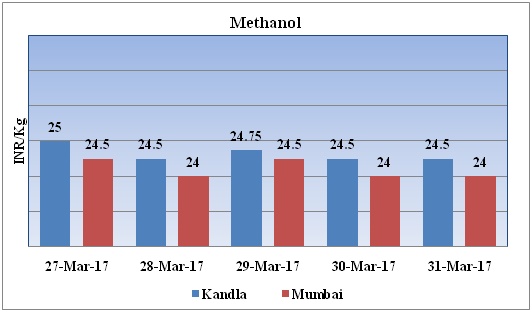

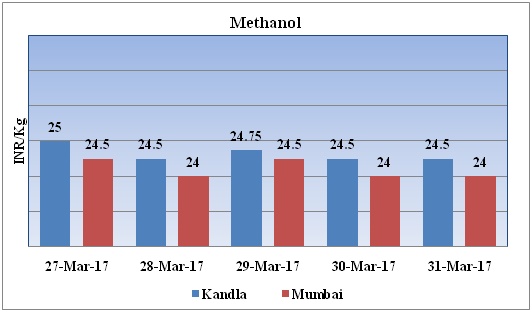

Weekly Price Trend: 27-03-2017 to 31-03-2017

- The above graph focuses on the Methanol price trend for the current week. Prices have followed volatile inclination for this week. By the end of the week prices were assessed around Rs.24.5/Kg for Kandla and Rs 24/kg Mumbai ports.

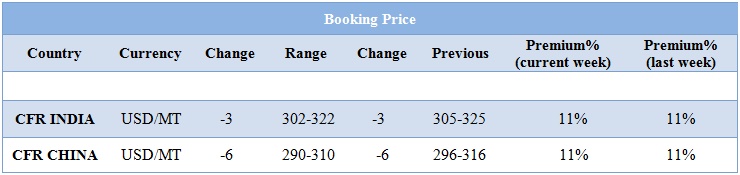

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed volatile inclination and by the end of the week prices were evaluated at Rs 24.5/kg for Kandla and Rs 24/kg for Mumbai ports.

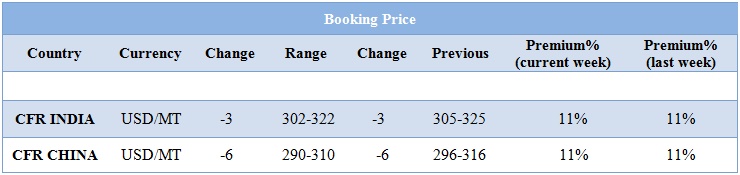

- CFR India prices were assessed in the range of USD 302-322/MTS. Prices have plunged in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 343/mt.

- CFR China prices were assessed in the range of USD 290-310/MT prices have decreased in compares to previous week.

- There has been reasonable decline in methanol values in China market. Experts believe that there are several reasons behind this decline and have may affect the futuristic scenario as well. After the spring festival market has recovered slowly in early February.

- The downstream market continues to remain weak further curtailing the domestic demand for methanol. One of the major consumers of methanol has been MTO plants in China. Since last few months production at units has dropped to negative.

- Further the restart of units in Iran and Saudi has gushed the supply in international market. As a result the import price and inland cargo has narrowed down to significant level.

- Margins of downstream production scratches back some of the losses as methanol price has dropped. It remains to be seen when the demand will recover for Methanol in China.

- This week with the little volatility prices have remained on the higher note with the expectation of extended supply cut. Brent and WTI crude both were assessed above $50 per barrel. Crude prices remain over 4 percent higher than they were on Tuesday. On Thursday prices have escalated as Kuwait gave its backing for an extension of OPEC production cuts in an attempt to reduce global oversupply.

- Market players have said that oil prices will higher as OPEC and non-OPEC oil production giant Russia would agree to continue their production cut deal seeking to drive prices higher.

- There remains doubt that the output cuts will go deep enough for the world's bloated markets to tighten soon and significantly lift prices, especially as other producers that are not part of the agreement could step in to fill the supply gap. Moreover some players have said that there is a tremendous amount of stock in the markets and to expect a major increase in the price is not very realistic

- On Thursday, closing crude values have increased.WTI on NYME closed at $50.35/bbl, prices have increased by $0.84/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.54/bbl in compared to last trading and was assessed around $52.96/bbl.

$1 = Rs. 64.85

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50