Methanol Weekly Report 31 January 2020

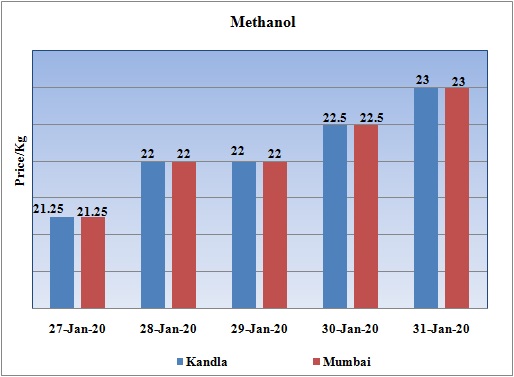

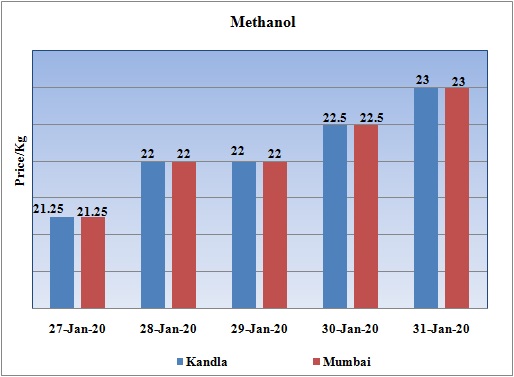

Weekly Price Trend: 27-01-2020 to 31-01--2020

- The above graph focuses on the Methanol price trend for the current week. Prices remained soft-to-firm throughout this week. Domestic prices were assessed at the level of Rs.23/Kg for bulk quantity although closed on higher note in compare to last week’s closing values.

- By the end of the week prices were assessed around Rs 23/Kg for Kandla and Mumbai ports.

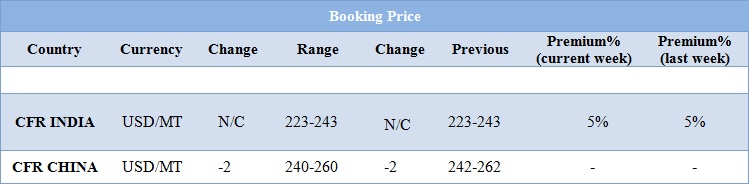

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have remained slightly firm for this week. There has been slight improvement in the demand sentiments. Prices in the domestic market were assessed at the level of Rs.23/Kg for bulk quantity.

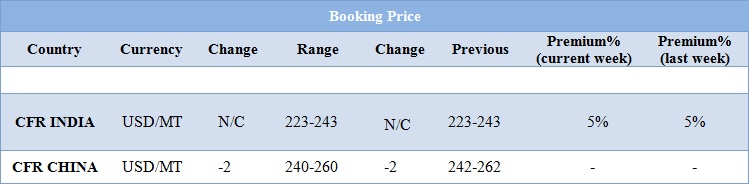

- CFR India prices were assessed around USD 233/MTS, with no change in prices for this week.

- China market also remained weak for this week. CFR China prices were assessed around USD 250/MT for this week.

- Benzene the major source for aromatic products also decline heavily for this week. FOB Korea values for Benzene were assessed around USD 675/MT for this week, reduced by USD 50/MT in one week while CFR China prices were assessed at the level of USD 690/MT for this week again reduced by USD50/MT for this week.

- Crude oil prices on Friday rose by Rs 81 to Rs 3,804 per barrel as speculators created fresh positions amid positive global trends. Analysts said raising of bets by participants kept crude prices higher in futures trade here. The flow of oil travelling from Latin America to China has stopped in the wake of the deadly outbreak of the coronavirus that has sunk oil prices to three-month lows, with no oil making its way from Brazil or Colombia to China since last week,

- Chinese refineries are responsible for taking one-third of all oil from Brazil, Colombia, and other Latin American countries.

- The demand for jet fuel and gasoline stemming from travel restrictions that have been put in place in an effort to stop the virus from spreading is expected to fall sharply, which will inevitably catch up to the refineries who are expected to cut back production at some point.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $52.14/bbl. Prices have decreased by 1.19/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is decreased by 1.52/bbl in compare to last closing price and was assessed around $58.29/bbl.

PLANT NEWS

QAFAC shut down its Methanol plant

Qatar Fuel Additive Co (QAFAC) has shut down its Methanol plant due to its technical issues. The operations have been put on halt in the first week of January 2020. Company has not specified yet for how long the unit is likely to remain off-stream.

Unit is based at Messaieed in Qatar, the natural gas based Methanol plant has a production capacity of 1.1 mln mt/year.

Methanol plant was shut down by Kaveh Methanol

Methanol was shut down by Kaveh Methanol due to shortage in the supply of natural gas. Since natural gas is the feedstock supply for Methanol plant. The unit was shut down last week and is likely to last till winter season in Iran. The government of feedstock supply of natural gas has been curtailed as it has been diverted towards domestic sector.

$1 = Rs. 71.34

Import Custom Ex. Rate USD/ INR: 71.65

Export Custom Ex. Rate USD/ INR: 69.95